In a statement that has sent ripples through both political and cryptocurrency circles, the Executive Director of the Presidential Council on Digital Assets revealed that the United States government’s decision to sell approximately 200,000 Bitcoin over the past decade represents a missed opportunity worth roughly $17 billion at current market prices.

Historic Sales Under Scrutiny

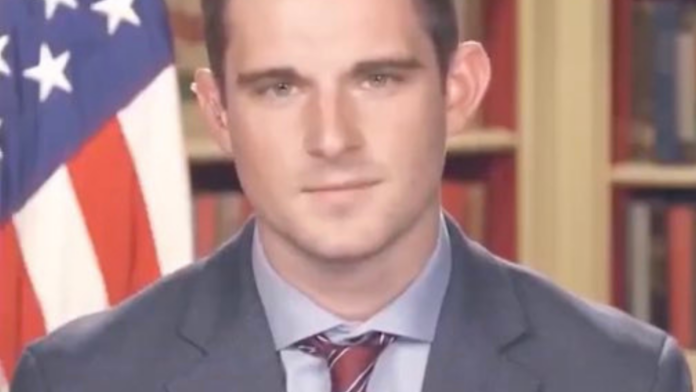

Speaking at a blockchain policy summit in Washington D.C., Executive Director Morgan Reynolds presented an analysis of Bitcoin liquidations conducted primarily by the U.S. Marshals Service, Department of Justice, and Internal Revenue Service between 2014 and 2023. These sales—originally from seizures related to criminal investigations including the Silk Road marketplace—were valued at approximately $1.2 billion at the time of their respective auctions.

“Had these assets remained under government control, they would represent a holding valued at approximately $17 billion today,” Reynolds stated. “This disparity highlights the challenges federal agencies face when handling emerging digital assets in an evolving regulatory landscape.”

The government’s most significant Bitcoin liquidation came following the 2013 shutdown of Silk Road, when authorities seized approximately 144,000 BTC from the darknet marketplace’s operator, Ross Ulbricht. Those coins were auctioned in multiple batches throughout 2014 and 2015, with winning bids averaging between $350-$600 per Bitcoin—a stark contrast to today’s valuation exceeding $85,000 per coin.

Market Reactions and Historical Context

Cryptocurrency markets demonstrated moderate volatility following Reynolds’ remarks, with Bitcoin briefly climbing 2.8% before settling at a 1.5% gain for the day. Market analysts suggest this reaction reflects both the significance of government involvement in crypto markets and the broader implications for institutional adoption.

“The government’s past approach to Bitcoin holdings represents a missed opportunity, but it also reflects the uncertainty that surrounded digital assets during that period,” explained Dr. Sarah Chen, Chief Economist at Digital Frontier Analytics. “Between 2014 and 2020, there was no established protocol for handling such assets, and many officials viewed immediate liquidation as the most prudent course of action given the perceived volatility and uncertain regulatory future.”

Historical data shows that federal agencies typically converted seized cryptocurrency to cash within 6-18 months of obtaining control, following standard protocols for managing confiscated assets. This approach aligned with the Treasury Department’s risk management guidelines, which prioritized stability over speculative holding.

Policy Implications and Future Directions

Reynolds’ comments come amid ongoing debates about how government entities should handle digital assets moving forward. The Presidential Council on Digital Assets, established in late 2023, has been tasked with developing comprehensive frameworks for federal handling of cryptocurrencies and blockchain technologies.

Several policy experts suggest Reynolds’ statement signals a potential shift in governmental approaches to digital asset management. Representative Thomas Merritt, who chairs the House Subcommittee on Financial Technology, called for a comprehensive review of existing protocols.

“We need to critically examine whether our current procedures for handling digital assets serve the long-term interests of American taxpayers,” Merritt said. “While hindsight is always 20/20, we should learn from past decisions to build more adaptive policies for the future.”

The Treasury Department has already begun piloting a Digital Asset Reserve Program, which allows certain seized cryptocurrencies to be held in secure federal wallets for limited periods rather than being immediately liquidated. The program includes strict oversight and predetermined liquidation schedules to balance potential appreciation against volatility risks.

International Comparisons

The United States is not alone in its approach to seized cryptocurrencies. Several other nations have followed similar liquidation policies, while a few have experimented with alternative strategies:

- Germany has maintained approximately 50,000 BTC seized from criminal enterprises, currently valued at over $4 billion, making it one of the largest known governmental Bitcoin holders.

- Bulgaria reportedly seized 213,519 BTC in 2017, though officials have never confirmed whether these assets remain under government control or have been sold.

- South Korea established a “digital asset custody framework” in 2021 that allows for strategic holding of seized cryptocurrencies based on market conditions and public interest assessments.

“Different jurisdictions are experimenting with various approaches,” explained Professor Elena Korshunova, who specializes in digital asset policy at Georgetown University. “We’re witnessing the early stages of governments developing methodologies for managing these new forms of value. The U.S. experience will undoubtedly influence global best practices moving forward.”

ALSO READ BlackRock Fund Holds $47.4M in Bitcoin ETF

Economic Perspectives on Government Holdings

Economists remain divided on whether long-term retention of seized cryptocurrencies represents sound fiscal policy. Critics argue that government holdings of volatile assets could create conflicts of interest in regulatory decisions and expose public finances to unnecessary risk.

“While the potential returns are obvious in retrospect, governments have different risk profiles and objectives than private investors,” said Federal Reserve economist Dr. Jonathan Harmon. “Treasury protocols are designed to ensure stability and predictability, not to maximize speculative returns.”

Proponents of more flexible holding policies counter that digital assets represent a new challenge requiring updated frameworks.

“Traditional asset management rules were developed for physical goods and fiat currencies,” argued Dr. Maya Peterson of the Brookings Institution. “Digital assets combine properties of currencies, commodities, and technologies in novel ways. Our management approaches need to evolve accordingly.”

Future Outlook

Reynolds indicated that the Presidential Council will release comprehensive recommendations for digital asset management later this year, potentially establishing new protocols for how federal agencies handle cryptocurrency seizures moving forward.

Sources familiar with the Council’s work suggest the recommendations will likely include:

- Creation of a centralized Digital Asset Management Office to coordinate holdings across agencies

- Development of risk-based retention guidelines that allow for partial holdings of certain assets

- Implementation of dollar-cost-averaging liquidation strategies rather than bulk auctions

- Establishment of clear thresholds and timelines for when assets must be converted to traditional currencies

“While we cannot undo past decisions, we can ensure future policies reflect both the risks and opportunities these assets present,” Reynolds concluded. “Our goal is to develop a framework that serves the public interest while acknowledging the unique characteristics of blockchain-based assets.”

The Council’s recommendations will require approval from multiple agencies, including the Treasury Department, Justice Department, and SEC, before implementation. Congressional oversight committees have also expressed interest in reviewing any proposed changes to existing protocols.

As Bitcoin continues its price discovery process fourteen years after its creation, the government’s historical relationship with the asset serves as a case study in how institutions adapt—sometimes belatedly—to technological innovation. What began as a fringe digital experiment has evolved into an asset class that commands attention from the highest levels of government, with policies still developing to address its unique properties.

For now, the $17 billion figure stands as a reminder of how quickly the landscape has changed—and how challenging it can be for institutional structures to adapt to emergent technologies whose future remains uncertain.

Never miss a beat in the crypto world! Check Crypto News Today for Bitcoin updates, Ethereum news, and the latest blockchain trends shaping the future of digital assets.