In an environment of economic uncertainty triggered by President Trump’s latest wave of tariffs, several cryptocurrencies are demonstrating remarkable resilience. Despite the broader crypto market experiencing significant downturns—with many major cryptocurrencies posting negative returns for the year—a select few digital assets have managed to buck this trend over the past month.

According to recent analysis by market experts, three cryptocurrencies in particular stand out as potential investment opportunities in this challenging landscape: Bitcoin, Solana, and Bittensor.

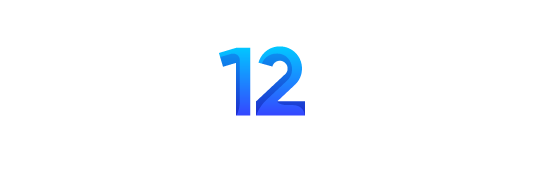

Bitcoin: The Digital Gold Thesis Gains Traction

Despite falling almost 20% from its January 2025 all-time high of $109,000, Bitcoin has shown signs of recovery with a nearly 5% gain over the past 30 days. Currently trading at approximately $93,722, Bitcoin appears to be reinforcing its “digital gold” narrative—positioning itself as a potential hedge against economic uncertainty, inflation, and geopolitical risk.

This thesis seems to be gaining mainstream acceptance, as evidenced by the reversal of investor flows into spot Bitcoin ETFs. After experiencing negative flows during February and March when investors retreated from risk assets, these ETFs have recently begun recording positive flows again in late April.

Market analysts suggest this trend reflects growing investor skepticism toward traditional markets, with Bitcoin emerging as an alternative store of value during turbulent economic times.

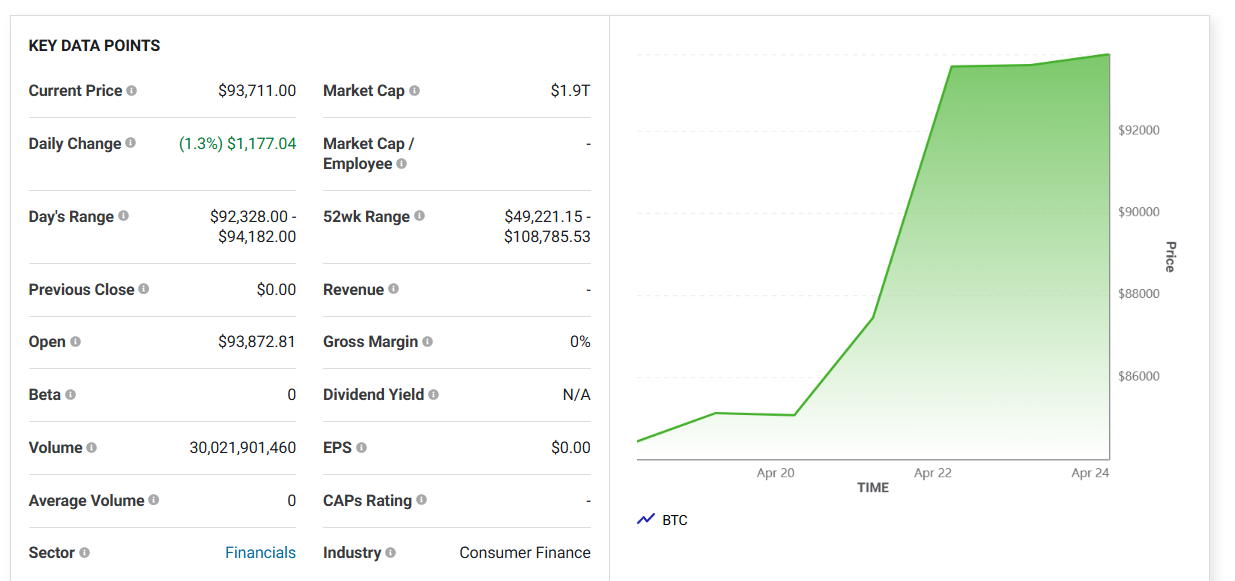

Solana: Challenging Ethereum’s Dominance

Solana has established itself as Ethereum’s primary competitor in the Layer-1 blockchain space. While Ethereum’s market capitalization still substantially exceeds Solana’s, recent performance metrics tell an interesting story of changing momentum.

While Ethereum remains down more than 50% year-to-date and nearly 20% over the past month, Solana has posted a 5% gain during the same 30-day period. Currently trading at about $154, Solana is gradually recovering from earlier losses this year.

Recent blockchain metrics further strengthen Solana’s position. The network has achieved several significant milestones, including:

- Surpassing Ethereum in 24-hour trading volume on its decentralized exchanges earlier this year

- Overtaking Ethereum in staking market capitalization in April

- Capturing nearly half (46%) of all decentralized application revenue in the blockchain ecosystem

These developments suggest Solana is experiencing unexpected growth despite current market uncertainties.

Also Read: What is Solana (SOL)?

Bittensor: Riding the AI Comeback Wave

Bittensor, now the 33rd largest cryptocurrency with a market capitalization approaching $3 billion, has emerged as the leading artificial intelligence cryptocurrency. Most impressively, Bittensor has surged approximately 30% over the past 30 days, signaling a potential revival of the AI investment thesis in the cryptocurrency space.

Described as an “open-source protocol that powers a decentralized, blockchain-based learning network,” Bittensor essentially functions as a blockchain platform specifically designed for AI projects.

What distinguishes Bittensor from other AI cryptocurrencies is its limited maximum supply of 21 million coins—identical to Bitcoin’s cap. This scarcity factor could potentially contribute to value preservation compared to competing AI cryptocurrencies with supply caps in the billions.

Long-Term Perspective Remains Essential

Financial experts caution that while these cryptocurrencies have shown short-term resilience, investors should maintain a long-term outlook rather than focusing on potential temporary gains resulting from tariff uncertainty.

The current economic climate remains unpredictable, with tariff policies subject to change and the outcomes of individual national negotiations with the White House still unclear, especially as the 90-day “cool off” period approaches its conclusion.

For those considering cryptocurrency investments in this volatile environment, Bitcoin’s established position and increasing acceptance as a potential hedge against economic instability make it particularly noteworthy among these three options.

As always, potential investors are advised to conduct thorough research and consider their risk tolerance before making investment decisions in the cryptocurrency market.

Want real-time updates on Bitcoin, Ethereum, and blockchain trends? Crypto News Today delivers breaking crypto news, expert insights, and price movements to keep you informed.