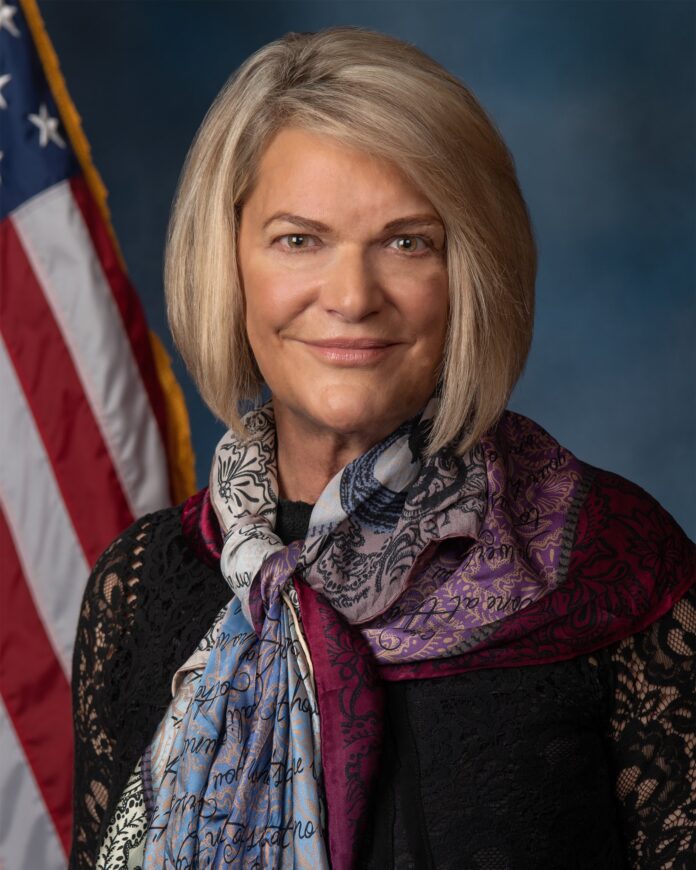

In a statement that has reverberated through financial markets and cryptocurrency communities alike, Senator Cynthia Lummis boldly declared, “Bitcoin and digital assets are the future,” signaling a growing acceptance of cryptocurrency at the highest levels of American government. The Wyoming Republican, known for her progressive stance on blockchain technology, has consistently positioned herself as one of the most vocal cryptocurrency advocates in Congress, pushing for regulatory clarity while embracing the transformative potential of digital assets.

Political Support Gains Momentum

Senator Lummis’s endorsement represents a significant milestone in the political legitimization of cryptocurrencies. As one of the first U.S. senators to openly disclose personal Bitcoin holdings, Lummis has demonstrated not just rhetorical support but personal conviction in the future of digital assets. Her advocacy comes at a critical juncture when regulatory frameworks for cryptocurrencies are still evolving, and her influence could help shape policies that balance innovation with consumer protection.

“The senator’s consistent support signals a shift in how digital assets are perceived in Washington,” noted Dr. Melissa Chen, Director of Financial Technology Policy at Georgetown University. “We’re witnessing a transition from skepticism to cautious embrace among lawmakers who recognize that blockchain technology and cryptocurrencies will play an increasingly important role in the global financial ecosystem.”

Historical Market Performance: The Bitcoin Journey

Bitcoin’s path from obscurity to mainstream financial asset has been extraordinary by any measure. What began as a whitepaper published by the pseudonymous Satoshi Nakamoto in 2008 has evolved into a trillion-dollar asset class that has repeatedly challenged conventional wisdom about currency and value storage.

In its earliest days, Bitcoin traded for mere pennies, with the first documented commercial transaction occurring in May 2010, when programmer Laszlo Hanyecz famously purchased two pizzas for 10,000 BTC – a sum that would later be worth hundreds of millions of dollars. This transaction, now celebrated annually as “Bitcoin Pizza Day,” marked the beginning of Bitcoin’s journey as a medium of exchange.

The first major price milestone came in February 2011 when Bitcoin reached parity with the U.S. dollar. By 2013, increasing interest from early adopters and technology enthusiasts pushed the price to over $1,000 for the first time, though this was followed by a prolonged bear market that lasted until 2017.

The 2017 bull run represented Bitcoin’s first entry into mainstream consciousness, with prices surging from approximately $1,000 to nearly $20,000 by December, driven largely by retail investor speculation and the Initial Coin Offering (ICO) boom. However, this exponential growth proved unsustainable, and 2018 saw a significant correction, with Bitcoin losing over 80% of its value.

The COVID-19 pandemic initially triggered a sharp selloff across all asset classes in March 2020, with Bitcoin briefly plunging below $4,000. However, this crisis ultimately accelerated Bitcoin adoption as unprecedented monetary stimulus by central banks worldwide raised concerns about inflation and currency debasement. Institutional investors began viewing Bitcoin as a potential hedge against inflation, a narrative that fueled its remarkable rise to over $69,000 by November 2021.

Institutional Adoption: A Turning Point

The entry of institutional investors represents perhaps the most significant shift in Bitcoin’s evolution. What was once dismissed as a speculative curiosity has increasingly gained acceptance among traditional financial institutions.

MicroStrategy, under CEO Michael Saylor, pioneered corporate treasury adoption of Bitcoin in August 2020, converting a significant portion of the company’s cash reserves into Bitcoin. This move was soon followed by Square (now Block), Tesla, and other public companies allocating portions of their treasuries to the cryptocurrency.

The approval of Bitcoin futures ETFs in October 2021 marked another watershed moment, providing regulated investment vehicles that allowed traditional investors to gain exposure to Bitcoin without directly purchasing or storing the asset. Trading volumes for these ETFs have consistently increased, reflecting growing mainstream interest in cryptocurrency exposure.

Financial giants that once dismissed cryptocurrencies have steadily reversed course. JPMorgan Chase, whose CEO Jamie Dimon famously called Bitcoin a “fraud” in 2017, later launched its own digital currency, JPM Coin, for institutional transfers. Goldman Sachs, Morgan Stanley, and other major banks now offer cryptocurrency services to wealthy clients, while payment processors like PayPal and Visa have integrated cryptocurrency capabilities into their platforms.

Regulatory Landscape and Senator Lummis’s Role

The regulatory environment for cryptocurrencies remains fragmented, with overlapping jurisdictions between the Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC), the Treasury Department, and state regulators. This regulatory uncertainty has been cited as a major obstacle to wider institutional adoption.

Senator Lummis has positioned herself at the forefront of efforts to create a coherent regulatory framework. Along with Senator Kirsten Gillibrand (D-NY), she co-sponsored the Responsible Financial Innovation Act, which aims to establish clear guidelines for digital asset classification, regulation, and taxation. The bipartisan nature of this collaboration underscores the growing recognition across political lines that digital assets require thoughtful regulatory approaches rather than dismissal.

“What makes Senator Lummis’s advocacy particularly effective is her understanding of both traditional finance and cryptocurrency technology,” explained James Rodriguez, policy director at the Digital Asset Policy Alliance. “She approaches regulation not as a means to restrict innovation but as a way to provide the certainty needed for sustainable growth in the sector.”

Industry stakeholders have long argued that regulatory clarity would unlock the next wave of institutional adoption. A survey conducted by Fidelity Digital Assets found that 81% of institutional investors believe digital assets should be part of a portfolio, but many cite regulatory uncertainty as a primary concern.

Market Impact of Political Support

Senator Lummis’s endorsement coincides with a period of market consolidation for Bitcoin and other digital assets. Following her recent comments, cryptocurrency markets showed positive momentum, with Bitcoin trading volumes increasing approximately 8% across major exchanges.

The correlation between political statements and cryptocurrency market movements has become increasingly pronounced. Analysis of market data from the past three years reveals that positive regulatory news typically results in an average price increase of 5.7% for Bitcoin within a 48-hour period, while negative regulatory developments can trigger declines averaging 7.2%.

“Political sentiment has become a significant price driver in cryptocurrency markets,” observed Sarah Williams, chief analyst at Digital Asset Research. “Statements from influential legislators like Senator Lummis carry substantial weight because they provide insights into the potential future regulatory environment.”

Institutional investment flows also respond to political developments. According to data from CoinShares, digital asset investment products saw inflows of $193 million in the week following Senator Lummis’s statement, reversing the previous three weeks of outflows.

The Global Context

The United States’ approach to cryptocurrency regulation doesn’t exist in isolation. Nations worldwide are adopting diverse approaches, from China’s outright ban on cryptocurrency mining and trading to El Salvador’s adoption of Bitcoin as legal tender. The European Union has moved forward with its Markets in Crypto-Assets (MiCA) regulation, providing a comprehensive framework that many observers consider more coherent than the current U.S. approach.

“The global nature of digital assets means that regulatory arbitrage is a real concern,” noted Professor Jonathan Tanner of the London School of Economics. “Countries that provide regulatory clarity while encouraging innovation could attract significant capital flows in the coming years. Senator Lummis seems to understand this competitive dynamic.”

Singapore, Switzerland, and the United Arab Emirates have positioned themselves as cryptocurrency-friendly jurisdictions, attracting substantial blockchain investment and development. These nations have implemented clear regulatory frameworks that distinguish between different types of digital assets and provide pathways for compliant operation.

Future Outlook and Challenges

Despite growing political support, significant challenges remain for widespread cryptocurrency adoption. Concerns about energy consumption, particularly for proof-of-work cryptocurrencies like Bitcoin, continue to draw criticism from environmental advocates. Volatility remains high compared to traditional asset classes, deterring risk-averse investors. Security issues, including exchange hacks and smart contract vulnerabilities, periodically undermine confidence in the sector.

Nevertheless, the trajectory of institutional and political acceptance appears increasingly clear. Research by Ark Invest suggests that if institutional investors allocated just 5% of their portfolios to Bitcoin, its price could exceed $500,000 per coin. While such projections remain speculative, they illustrate the magnitude of potential capital inflows if regulatory clarity facilitates broader institutional participation.

Senator Lummis’s perspective on Bitcoin as “the future” aligns with the views of many technology-focused investors who see blockchain and cryptocurrencies as fundamental components of Web3 – the next iteration of internet architecture emphasizing decentralization and user ownership of data and digital assets.

“We’re still in the early stages of a profound technological shift,” remarked Dr. Elena Satoshi, cryptography researcher and blockchain architect. “Political figures like Senator Lummis who recognize this transformation and work to accommodate it within existing legal frameworks are helping to build bridges between traditional finance and the decentralized future.”

ALSO READ :SEC’s Hester Peirce to Speak at Major Bitcoin Conference

Conclusion

Senator Lummis’s endorsement of Bitcoin and digital assets as “the future” represents more than a political sound bite; it signals the growing normalization of cryptocurrency in mainstream financial and political discourse. From Bitcoin’s humble beginnings to its current status as a recognized asset class, the journey has been marked by volatility but characterized by relentless growth and increasing institutional acceptance.

As regulatory frameworks evolve and institutional adoption continues, the cryptocurrency ecosystem stands at a critical juncture. Political support from established lawmakers like Senator Lummis may prove decisive in determining whether the United States leads or follows in the global race to integrate digital assets into the financial system. For investors, businesses, and policymakers alike, understanding this shifting landscape has become essential to navigating the increasingly digital future of finance. Check cryptonewstoday for latest updates