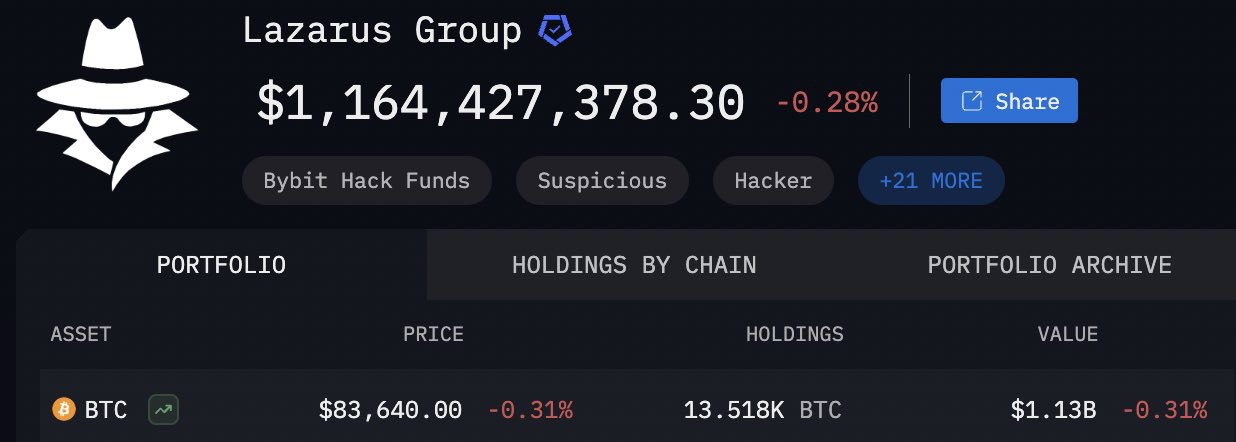

In a significant development that has sent ripples through the cryptocurrency market, North Korea’s notorious hacking collective, the Lazarus Group, has reportedly accumulated over $1

billion worth of Bitcoin, with a substantial portion stemming from the high-profile Bybit exchange hack. This revelation marks a pivotal moment in the ongoing saga of state-sponsored cryptocurrency theft and raises serious concerns about market stability, international security, and the evolving landscape of digital asset protection.

Source taken from Bitcoin magazine

The Bybit Breach: Anatomy of a Sophisticated Attack

The Bybit exchange hack, which occurred earlier this year, saw the theft of hundreds of millions in various cryptocurrencies. Investigators have now linked a significant portion of these stolen assets to wallets associated with the Lazarus Group. The hackers employed sophisticated techniques to bypass security measures, including spear-phishing attacks targeting exchange employees and exploiting previously unknown vulnerabilities in Bybit’s infrastructure.

“The technical sophistication demonstrated in this attack aligns with previous operations attributed to the Lazarus Group,” noted cybersecurity expert Marcus Chen. “Their ability to convert stolen assets to Bitcoin while evading detection shows their evolving capabilities in blockchain obfuscation techniques.”

According to blockchain analytics firm Elliptic, the hackers initially exfiltrated funds in multiple cryptocurrencies, including Ethereum, Solana, and various stablecoins. Within hours, these assets were routed through a complex network of wallets and decentralized exchanges, ultimately converting most of the value to Bitcoin. This conversion strategy offers several advantages to the hackers, including Bitcoin’s relative stability, liquidity, and the robust mixing services available for obfuscating transaction trails.

The attack vector itself demonstrated remarkable sophistication. Initial access was gained through a targeted spear-phishing campaign directed at Bybit’s DevOps team. Once inside the network, the attackers moved laterally, establishing persistence mechanisms and ultimately compromising the exchange’s hot wallets. The operation showed patience and meticulous planning, with evidence suggesting the attackers had maintained access to parts of Bybit’s infrastructure for weeks before executing the final theft.

Market Impact: Immediate and Long-Term Implications

The revelation of the Lazarus Group’s billion-dollar Bitcoin holdings has triggered measurable market responses across the cryptocurrency ecosystem:

In the immediate aftermath of the news, Bitcoin experienced a 4.3% price drop, with trading volume surging approximately 35% as market participants adjusted their positions. This volatility was amplified in the derivatives market, where Bitcoin futures saw nearly $400 million in liquidations within a 24-hour period.

Bybit’s native token suffered a more dramatic 12% decline as confidence in the exchange’s security was shaken. The exchange has since implemented additional security measures and completed a third-party security audit in an attempt to restore user trust.

The broader cryptocurrency market experienced increased volatility, with the Crypto Fear & Greed Index shifting from “Neutral” to “Fear” territory within hours of the report. Mid-cap altcoins were particularly affected, with market-wide losses averaging 7-9% among the top 100 cryptocurrencies by market capitalization.

Beyond these immediate effects, market analysts are concerned about the potential for strategic selling by the Lazarus Group. “A billion dollars in Bitcoin represents significant selling pressure if deployed systematically,” explained cryptocurrency market analyst Sarah Yamamoto. “We’re seeing increased demand for put options as traders hedge against the possibility of large-scale liquidations.”

Institutional investors have responded with caution, with several cryptocurrency investment products reporting outflows in the days following the news. This contrasts with the generally positive institutional sentiment that had characterized the market in recent months.

Historical Context: The Evolution of North Korean Crypto Theft

This incident follows a pattern of North Korean state-sponsored cryptocurrency theft that has evolved significantly over the past seven years. According to blockchain intelligence firm Chainalysis, North Korean hackers stole an estimated $1.7 billion in cryptocurrency in 2022 alone, representing a substantial portion of the country’s foreign currency earnings.

The Lazarus Group’s cryptocurrency operations have evolved through several distinct phases:

Early Exchange Targets (2017-2019)

The group’s initial focus was on centralized exchanges with weaker security infrastructure. Notable victims included South Korea’s Bithumb (multiple attacks totaling over $60 million), Japan’s Coincheck ($530 million in NEM tokens), and Slovenia’s Bitstamp ($5 million).

DeFi Exploration (2020-2021)

As centralized exchanges strengthened their security measures, the Lazarus Group shifted focus to decentralized finance protocols. This period saw the targeting of cross-chain bridges and liquidity pools, with attacks becoming more technically sophisticated. The KuCoin breach ($275 million) represented a transitional attack that targeted both centralized and decentralized infrastructure.

Advanced Persistent Threats (2022-Present)

The most recent phase has seen the group employ advanced persistent threat (APT) tactics, maintaining long-term access to compromised systems and conducting extensive reconnaissance before executing thefts. The Bybit attack exemplifies this approach, with evidence suggesting the attackers had established persistence in the network for months before the actual theft.

“What we’re seeing is an evolution from opportunistic hacking to strategic, patience-driven operations,” explained cybersecurity researcher Dr. Aisha Nakamura. “The Lazarus Group is increasingly behaving like a sophisticated financial institution, carefully managing their cryptocurrency portfolio and timing their conversions to maximize value.”

International Response: Sanctions, Tracking, and Cooperation

The international community has mobilized in response to this escalating threat. The U.S. Treasury Department’s Office of Foreign Assets Control (OFAC) has placed several cryptocurrency addresses associated with the Lazarus Group on its sanctions list, making it illegal for U.S. entities to transact with these addresses.

Law enforcement agencies worldwide are collaborating through INTERPOL’s Cyber Fusion Centre to track these illicit funds. However, the decentralized nature of cryptocurrency presents significant challenges to traditional asset freezing methods.

Financial intelligence units from over 40 countries have formed a specialized working group dedicated to tracking North Korean cryptocurrency holdings. This unprecedented level of international cooperation reflects the seriousness with which governments are treating this threat to financial stability and national security.

“We’re seeing innovations in blockchain forensics specifically designed to counter North Korean obfuscation techniques,” noted former intelligence analyst Jonathan Burke. “The cat-and-mouse game between trackers and hackers has accelerated technological development on both sides.”

Cryptocurrency exchanges have also responded to the threat, implementing enhanced Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures. Many major exchanges now utilize specialized transaction monitoring systems designed to flag patterns associated with North Korean laundering operations.

Industry Response: Strengthening the Shields

The cryptocurrency industry has responded to this crisis with unprecedented levels of cooperation and security investment. A consortium of major exchanges has established a real-time threat intelligence sharing network, allowing for rapid dissemination of information about emerging attack vectors.

Bybit has taken particular steps to rebuild trust, including:

- Engaging three independent security firms to conduct comprehensive audits

- Implementing a new multi-signature wallet architecture requiring approval from geographically dispersed security teams

- Establishing an insurance fund to cover potential future losses

- Deploying advanced behavioral analytics to detect anomalous employee activities

Smaller exchanges and DeFi protocols have also strengthened their security postures, with many implementing mandatory security reviews and bug bounty programs. The DeFi sector has seen particular innovation in security mechanisms, with new protocols increasingly incorporating circuit breakers and time-locked transactions that can help mitigate the impact of successful attacks.

“We’re seeing a maturation of the industry’s approach to security,” said blockchain security expert Michael Rodriguez. “There’s growing recognition that security is not just a technical challenge but also an organizational and procedural one.”

Economic Impact on North Korea and Geopolitical Implications

The Lazarus Group’s cryptocurrency operations have become a crucial source of foreign currency for sanctions-hit North Korea. Experts estimate that cryptocurrency theft may account for up to 15% of the country’s foreign currency earnings, making it a vital economic lifeline.

This creates complex geopolitical dynamics, as traditional sanctions become less effective against a regime increasingly funded through digital assets. Some analysts suggest that North Korea’s growing cryptocurrency holdings could potentially influence its strategic calculus, providing a financial buffer that might embolden the regime.

“We’re entering uncharted territory where a nation-state’s financial stability is increasingly tied to an asset class designed to resist state control,” explained international relations scholar Dr. Elena Petrov. “This creates novel challenges for international security frameworks designed for the traditional financial system.”

Looking Ahead: Future Risks and Preparations

As the cryptocurrency industry absorbs this latest shock, attention is turning to potential future developments. Security experts warn that the Lazarus Group’s accumulated expertise and resources could enable even more sophisticated attacks in the future.

Particular concerns include:

- Potential targeting of cryptocurrency infrastructure providers rather than just exchanges

- Advanced supply chain attacks targeting the development environments of blockchain projects

- Exploitation of zero-day vulnerabilities in smart contract platforms

- Increasingly sophisticated social engineering targeting key personnel at major exchanges

Market participants are also developing contingency plans for potential large-scale Bitcoin liquidations. Some institutional investors have established event-triggered trading algorithms designed to mitigate volatility in the event of suspicious large-scale selling activity.

“The market is becoming more resilient to these shocks,” noted cryptocurrency economist Dr. Marco Williams. “While the immediate impact of the Bybit hack news was significant, we’re seeing faster recovery times as the market develops antibodies to these types of events.”

Conclusion: A Watershed Moment

The Lazarus Group’s billion-dollar Bitcoin accumulation represents a watershed moment in the cryptocurrency industry’s ongoing security evolution. It highlights both the vulnerabilities that remain in the ecosystem and the increasingly sophisticated responses being developed by industry participants and regulatory bodies.

As cryptocurrency continues its integration into the global financial system, the security challenges posed by state-sponsored actors like the Lazarus Group will likely intensify. The industry’s ability to adapt to these threats while maintaining the open, accessible nature of blockchain technology will be crucial to its long-term success.

For now, market participants, security professionals, and government agencies remain vigilant, watching for any signs of movement in the Lazarus Group’s substantial Bitcoin holdings while working to strengthen defenses against future attacks. This delicate balance between innovation and security will continue to define the cryptocurrency landscape in the years ahead. Check cryptonewstoday for latest updates

ALSO READ :Rep. Byron Donalds Pushes Bill to Secure Bitcoin Reserve