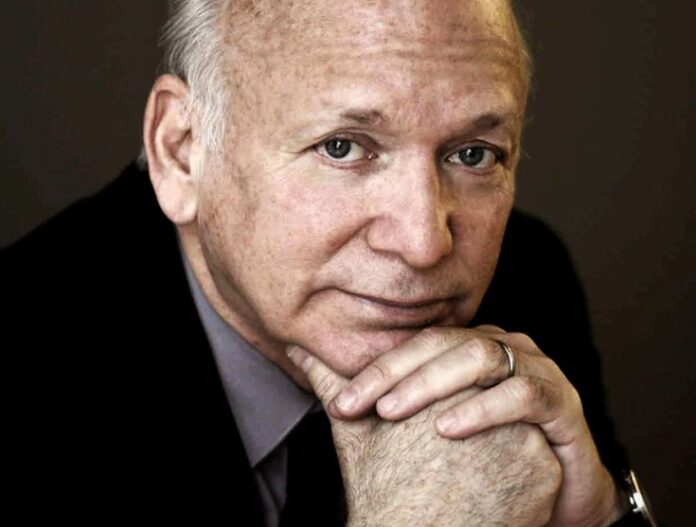

In a striking proclamation that has sent ripples through the cryptocurrency community, Nobel Prize-winning economist Eugene F. Fama has predicted that Bitcoin, despite its current impressive valuation near $96,731, will become worthless within the next decade. This bold forecast comes at a particularly interesting moment, as the cryptocurrency market reaches new heights with a global market cap exceeding $3.15 trillion.

The Voice of Experience

Fama, who won the Nobel Prize in Economic Sciences in 2013 for his groundbreaking work on asset prices and is renowned as the father of the efficient market hypothesis, brings considerable weight to this debate. His prediction isn’t merely speculation but stems from fundamental economic principles that he argues Bitcoin violates.

“It’s only digital gold if it has a use,” Fama emphasized in a recent podcast appearance. “If it doesn’t have a use, it’s just paper. Not paper, it’s air, not even air.” This stark assessment cuts to the heart of the ongoing debate about Bitcoin’s intrinsic value.

The Fundamental Contradictions

At the core of Fama’s criticism lies what he sees as an inherent contradiction in Bitcoin’s design. As a medium of exchange, cryptocurrencies face a fundamental challenge: they lack the stability that traditional currencies require to function effectively. The fixed supply model that Bitcoin champions, while attractive to those worried about inflation, creates a volatile price environment that undermines its utility as a currency.

The economist points out that this volatility isn’t just a temporary feature but a structural issue. “Cryptocurrencies are such a puzzle because they violate all the rules of a medium of exchange,” Fama explains. “They don’t have a stable real value. They have highly variable real value. That kind of a medium of exchange is not supposed to survive.”

Implications for Economic Theory

Perhaps most intriguingly, Fama suggests that Bitcoin’s continued existence poses a challenge to established economic principles. “I’m hoping it will bust,” he admits, “because if it doesn’t, we have to start all over with monetary theory.” This candid admission highlights the extent to which cryptocurrencies have disrupted traditional economic thinking.

The statement reflects a broader concern: if Bitcoin maintains its value long-term, economists might need to fundamentally rethink their understanding of money and markets. This could represent the most significant shift in monetary theory since the abandonment of the gold standard.

Technical and Practical Challenges

Beyond the theoretical concerns, Fama points to practical issues that could undermine Bitcoin’s long-term viability. The blockchain technology underlying Bitcoin, while innovative, faces significant challenges:

– Energy consumption remains a critical concern, with Bitcoin mining requiring substantial computational power

– Security risks persist, as Fama notes that coordinated attacks could potentially compromise the blockchain

– Scalability issues continue to limit Bitcoin’s practical utility for everyday transactions

The Regulatory Horizon

The intersection of cryptocurrency with traditional financial systems presents another layer of complexity. Fama predicts that government intervention becomes increasingly likely as the crypto market grows, particularly if a major crash occurs. His libertarian leanings make him skeptical of government involvement, yet he acknowledges the practical reality that regulators will feel pressured to act if cryptocurrencies “blow up.”

A Limited Use Case

Interestingly, Fama does acknowledge one potential use case for Bitcoin: as a hedge for ultra-wealthy individuals facing political risk. However, this niche application doesn’t alter his overall assessment of Bitcoin’s future prospects. The limited utility of Bitcoin as a tool for wealth preservation in specific circumstances doesn’t justify its current valuation or ensure its long-term survival.

Looking Ahead

As Bitcoin continues to trade near all-time highs and cryptocurrency adoption grows, Fama’s prediction stands in stark contrast to the optimism of crypto advocates. His analysis suggests that the current valuation reflects speculation rather than fundamental value, a situation he believes is ultimately unsustainable.

The coming decade will test Fama’s prediction. If he’s correct, we may witness one of the most spectacular asset collapses in financial history. If he’s wrong, as he himself acknowledges, economic theorists will need to revise their understanding of monetary systems fundamentally.

For investors and observers alike, Fama’s warning serves as a reminder that even as cryptocurrencies reach new heights, fundamental questions about their long-term viability remain unresolved. As the debate continues, his insights offer a valuable perspective grounded in classical economic theory, even as that theory itself faces challenges from the very innovation he critiques.

The truth likely lies somewhere between the extreme positions of crypto evangelists and complete skeptics. Whatever the outcome, Fama’s prediction ensures that the next decade will be closely watched by economists, investors, and technology enthusiasts alike.

ALSO READ :Bitcoin, Crypto Stocks Drop Due to Trump Tariffs Concerns