MicroStrategy executive argues Bitcoin protocol will adapt through software upgrades when quantum threat becomes real

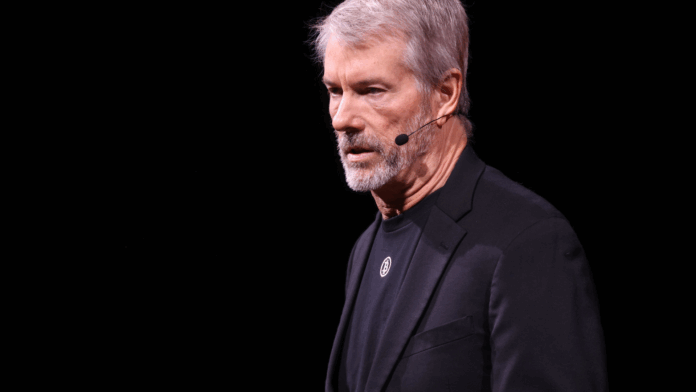

MicroStrategy’s Michael Saylor has pushed back against growing concerns that quantum computing poses an existential threat to Bitcoin, dismissing much of the alarm as marketing tactics designed to promote alternative cryptocurrency projects.

Speaking on CNBC, Saylor downplayed the quantum computing threat that has been highlighted by major financial institutions like BlackRock. While BlackRock has warned that quantum computers could eventually break the traditional encryption that underpins Bitcoin’s security and scarcity model, Saylor argued that the Bitcoin network would simply adapt through software upgrades when necessary.

“It’s mainly marketing from people that want to sell you the next quantum yo-yo token,” Saylor said on CNBC. “Google and Microsoft aren’t going to sell you a computer that cracks modern cryptography because it would destroy Google and Microsoft – and the U.S. Government and the banking system.”

Also Read: Strategy Announces $250 Million STRD Stock Offering to Fund Bitcoin Expansion

Protocol Evolution Over Panic

Saylor’s central argument rests on Bitcoin’s ability to evolve as a protocol. “Bitcoin is a protocol; the software gets upgraded every year,” Saylor concluded, arguing that the bigger security threat for bitcoin is phishing.

The MicroStrategy executive’s confidence stems from existing work already underway to address quantum threats. Several proposals are being developed to secure Bitcoin’s Proof of Work consensus mechanism against quantum computing attacks, including efforts by BTQ, a startup focused on quantum-proof crypto hardware. Additionally, one Bitcoin developer has drafted a Bitcoin Improvement Protocol proposing a hard fork that would migrate all wallets to quantum-secure addresses.

Industry Divided on Quantum Preparedness

However, Saylor’s optimistic view doesn’t reflect a universal consensus within the cryptocurrency industry. A recent report from Presto Research argued that the crypto industry is “unprepared” for the coming quantum threat.

The debate highlights a fundamental tension in the cryptocurrency space between those who view quantum computing as a manageable future challenge and those who see it as an immediate concern requiring urgent preparation.

Stay ahead with real-time crypto live news updates on Bitcoin, Ethereum, altcoins, market trends, and blockchain innovations.

Market Remains Unfazed

Despite the ongoing debate about quantum threats, Bitcoin traders appear largely unconcerned. With BTC above $100K and the market getting ready to challenge another all-time high, traders just don’t seem to be concerned. Bitcoin was trading flat at $105,600.30 as of the latest market data.

Technical Reality Check

Saylor’s argument that major technology companies won’t develop quantum computers capable of breaking modern cryptography contains a logical foundation. Such computers would indeed pose risks to the entire digital infrastructure that these companies depend on, from cloud services to financial systems. This mutual vulnerability creates incentives for the technology industry to develop quantum-resistant solutions rather than quantum-breaking tools.

The quantum computing threat to Bitcoin isn’t entirely theoretical, but it also isn’t imminent. Current quantum computers lack the computational power needed to break Bitcoin’s SHA-256 encryption, and experts generally agree that sufficiently powerful quantum computers remain years away from practical deployment.

how much real volume do stablecoins do? how much is payments versus trading-related? it’s one of the hardest empirical questions. I personally have been trying to find the answer for over 5 years now.

we know the “raw” numbers aren’t very useful because of MEV bots, exchange… pic.twitter.com/W4VBW7JM1M

— nic carter (@nic__carter) June 6, 2025

Broader Crypto Market Developments

The quantum computing discussion comes amid other significant developments in the cryptocurrency space. Circle, the stablecoin issuer, recently completed a successful IPO, with shares rallying from an opening price of $69 to over $107. Meanwhile, Gemini, the cryptocurrency exchange founded by the Winklevoss twins, has confidentially filed for its own IPO with the SEC.

The stablecoin market, valued at $254 billion according to CoinGecko data, continues to grow, though questions remain about how much stablecoin volume represents genuine payments versus trading activity.

As the cryptocurrency industry matures and moves toward greater mainstream adoption, debates over security threats like quantum computing will likely intensify. For now, Saylor’s position represents confidence in Bitcoin’s adaptability, while critics argue for more proactive preparation against quantum threats.

The ultimate resolution may depend on the timeline for practical quantum computing development and the cryptocurrency community’s ability to implement protective measures before any real threat emerges.

CryptoNewsToday is a leading platform providing the latest updates, trends, and analysis in the cryptocurrency world. Stay informed with timely news on Bitcoin, altcoins, blockchain technology, and more.