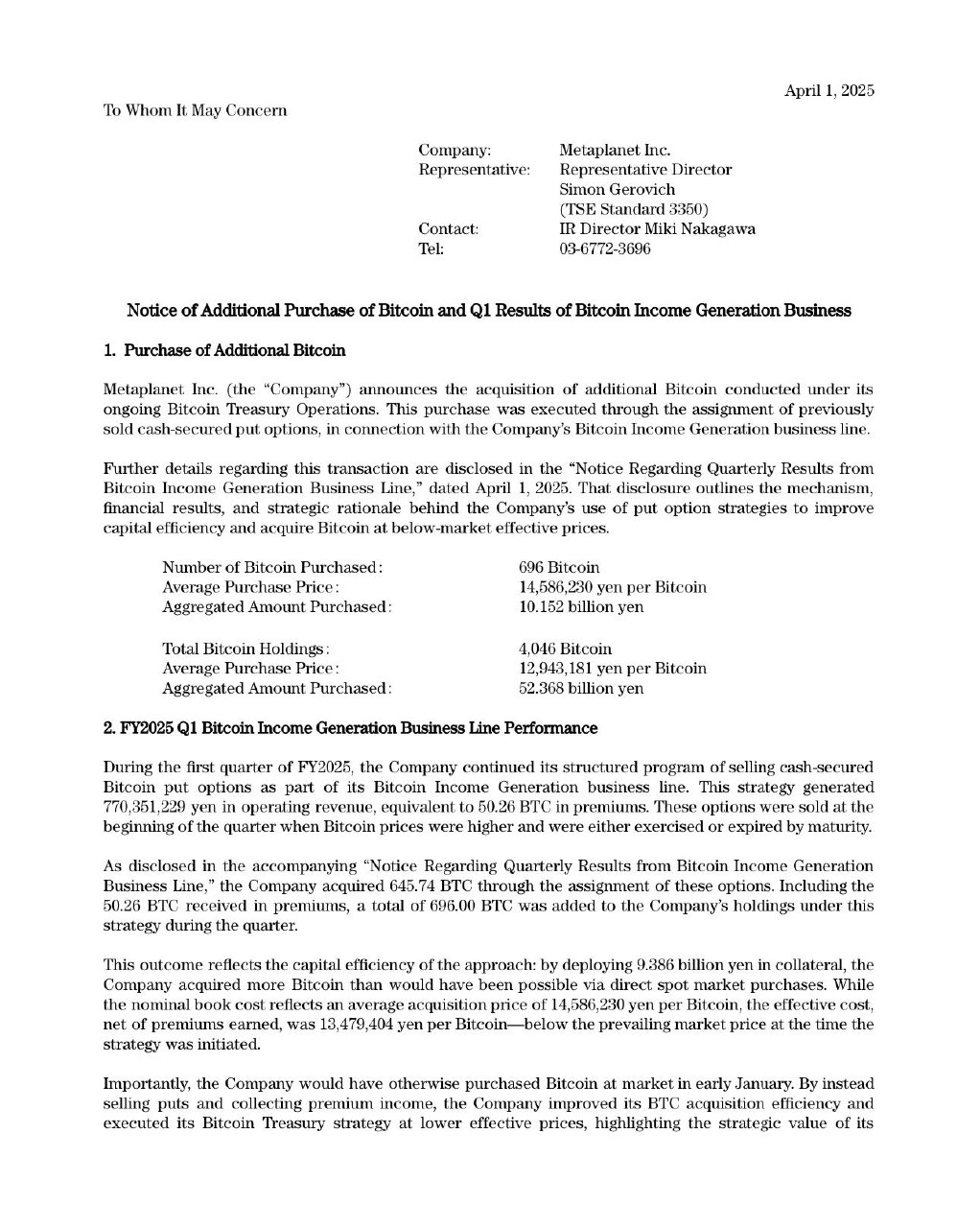

Japanese hotel company Metaplanet Inc. (TSE: 3350) has acquired an additional 696 Bitcoin (BTC) for approximately ¥10.15 billion ($97.5 million), bringing its total holdings to 4,046 BTC, according to a company announcement dated April 1, 2025.

Strategic Bitcoin Acquisition Through Options Trading

The latest purchase was executed as part of Metaplanet’s Bitcoin Treasury Operations through a sophisticated options strategy. According to the company’s notice, these bitcoins were acquired at an average purchase price of ¥14,586,230 ($97,500) per coin.

“This outcome reflects the capital efficiency of the approach,” the company stated in its disclosure. “By deploying 9.386 billion yen in collateral, the Company acquired more Bitcoin than would have been possible via direct spot market purchases.”

The acquisition was financed through the sale of cash-secured Bitcoin put options during Q1 2025, a strategy that generated ¥770.3 million (approximately $5.13 million) in operating revenue, equivalent to about 50.26 BTC in premiums. These options were written at the beginning of the quarter when Bitcoin was trading at all-time highs above $100,000.

While the nominal book cost reflects an average acquisition price of ¥14,586,230 per Bitcoin, the effective cost, net of premiums earned, was ¥13,479,404 per Bitcoin — notably below market prices at the time the strategy was initiated.

Rising Through the Ranks of Corporate Bitcoin Holders

With this latest acquisition, Metaplanet has solidified its position as Asia’s largest corporate Bitcoin holder and the ninth-largest public holder of Bitcoin globally, according to data from Bitcoin Treasuries. The company’s total BTC holdings were purchased for an average price of around ¥12,943,181 ($86,500.57) per coin, with an aggregated amount of ¥52.368 billion invested.

JUST IN: @Metaplanet_JP has added 696 BTC to their corporate #Bitcoin treasury.

📊 BTC Yield: 95.6% YTD 2025

🏦 Total Holdings: 4,046 BTCMetaplanet generated ¥770.35 million (~$5.16 million) in Q1 2025 from their Bitcoin Income Generation. pic.twitter.com/V4aejya7Mq

— Bitcoin For Corporations (@BitcoinForCorps) April 1, 2025

“Relative to direct spot purchase at that time, the strategy enabled the company to acquire more bitcoin per yen deployed — benefitting from premium income and a reduced effective cost basis,” Metaplanet said in its statement.

The news had a positive impact on the company’s stock performance, with shares closing 2% higher at ¥409 on Tuesday, outperforming the broader Nikkei 225 index, which remained unchanged on the day.

Following in Strategy’s Footsteps

Metaplanet has been methodically following the playbook established by U.S.-based Strategy (formerly MicroStrategy), which pioneered the corporate Bitcoin treasury approach. The Japanese firm has publicly set an ambitious target of accumulating 21,000 BTC by 2026 — a symbolic figure that references Bitcoin’s maximum supply cap of 21 million coins.

Earlier in March, Metaplanet’s stock jumped 19% in less than a day after it invested $44 million to add Bitcoin to its balance sheet. This was part of a series of purchases, including separate acquisitions of 150 BTC and 156 BTC in the same month.

The company’s focus on Bitcoin has been transformative for its business. According to recent reports, Metaplanet posted its first operating profit in seven years, boosted by its growing Bitcoin portfolio and trading strategies.

Financing Bitcoin Acquisitions Through Bonds

Metaplanet has been creative in financing its Bitcoin acquisitions. According to Cointelegraph, the company issued ¥2 billion ($13.3 million) in zero-interest bonds on March 31, 2025, allocated via its Evo Fund to fuel additional Bitcoin purchases. Investors who purchased these securities will be able to redeem them at full face value by September 30.

CEO Simon Gerovich explained in a social media post that the company was taking advantage of the recent downturn in Bitcoin prices, which had fallen approximately 25% from its all-time high of over $109,000.

押し目買い!

Buying the dip! https://t.co/nOIQrAveap— Simon Gerovich (@gerovich) March 31, 2025

Global Expansion and Strategic Appointments

Metaplanet’s ambitions extend beyond simply accumulating Bitcoin. The company has begun exploring a potential U.S. listing to make its shares more accessible to global investors.

“We are considering the best way to make Metaplanet shares more accessible to investors around the world,” Gerovich stated, according to Cointelegraph.

In a move that signals the company’s growing political connections, Metaplanet appointed Eric Trump, son of U.S. President Donald Trump, to its newly established strategic board of advisers in early March. Company representatives stated that Eric Trump “brings a wealth of experience in real estate, finance, brand development, and strategic business growth and has become a leading voice and advocate of digital asset adoption worldwide.”

This appointment comes as the Trump administration has established a more favorable regulatory environment for cryptocurrencies, potentially benefiting companies with significant Bitcoin holdings like Metaplanet.

A Model for Corporate Bitcoin Strategy

Metaplanet’s approach to Bitcoin acquisition provides a blueprint for other corporations considering similar strategies. By using options trading, bond issuances, and other financial instruments, the company has demonstrated ways to acquire Bitcoin at below-market effective prices.

“Importantly, the Company would have otherwise purchased Bitcoin at market in early January,” the company noted in its disclosure. “By instead selling puts and collecting premium income, the Company improved its BTC acquisition efficiency and executed its Bitcoin Treasury strategy at lower effective prices, highlighting the strategic value of its approach.”

This model may be particularly appealing as more corporations look to diversify their treasury holdings amid economic uncertainty and inflation concerns. Metaplanet’s success could inspire other Asian companies to follow suit, potentially expanding the corporate adoption of Bitcoin beyond the current concentration in North American firms.

Market Context and Future Outlook

Metaplanet’s latest Bitcoin purchase comes amid a period of volatility for the cryptocurrency market. After reaching an all-time high above $109,000 earlier in the quarter, Bitcoin has experienced a correction, trading around $84,300 as of April 1, 2025, according to CoinDesk data.

Despite this pullback, institutional interest in Bitcoin remains strong, with Metaplanet’s acquisition strategy demonstrating confidence in the long-term value proposition of the digital asset. The company’s use of put options also suggests a sophisticated understanding of market cycles and a willingness to capitalize on price volatility.

As Metaplanet continues its journey toward its goal of 21,000 BTC, market observers will be watching closely to see if other corporations follow its lead. The company’s innovative financing strategies, combined with its clear long-term vision, position it as a significant player in the corporate Bitcoin adoption narrative.

With its growing Bitcoin reserves, expanding global presence, and strategic political connections, Metaplanet is transforming from a traditional Japanese hotel company into a leading corporate advocate for Bitcoin adoption in the Asia-Pacific region and beyond.

Get real-time updates on Crypto News Today, covering Bitcoin price changes, blockchain innovations, and expert analysis to keep you ahead in the fast-paced world of cryptocurrency.