In a significant move reinforcing its commitment to cryptocurrency as a treasury asset, Japanese technology corporation Metaplanet Inc. has announced the acquisition of an additional 162 Bitcoin worth approximately ¥2 billion ($13.5 million at current exchange rates). This latest purchase continues the company’s aggressive Bitcoin treasury operations strategy that has seen its holdings grow to 3,050 Bitcoin valued at over ¥38.4 billion ($260 million).

Metaplanet’s Latest Bitcoin Acquisition

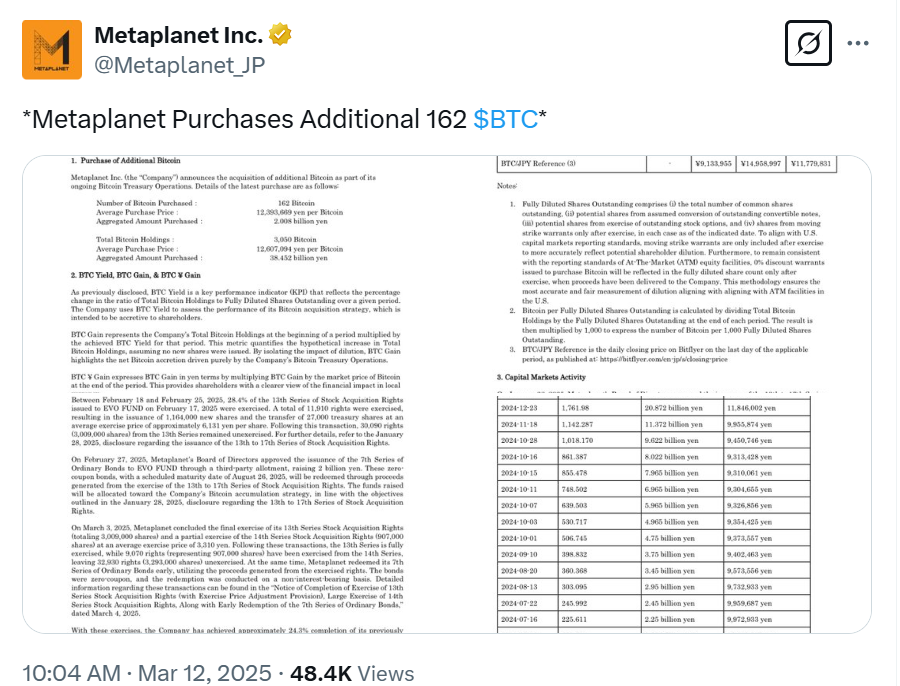

According to an official notice released today, Metaplanet completed its latest Bitcoin purchase at an average price of ¥12,393,669 per Bitcoin (approximately $84,000). The company’s representative director, Simon Gerovich, authorized the transaction as part of Metaplanet’s ongoing Bitcoin Treasury Operations.

The notice, signed by IR Director Miki Nakagawa, details that this latest purchase brings Metaplanet’s total Bitcoin holdings to 3,050 coins, acquired at an average price of ¥12,607,094 per Bitcoin (approximately $85,500). The company has now invested a total of ¥38.452 billion (roughly $260 million) in Bitcoin as part of its corporate treasury strategy.

This purchase follows a series of strategic financial maneuvers executed by Metaplanet in early 2025. On February 13, 2025, the company confirmed receipt of ¥4 billion raised through its 6th Series of Ordinary Bonds issued to EVO FUND, which allowed the company to accelerate its Bitcoin purchases. Shortly afterward, on February 19, Metaplanet completed an early redemption of ¥2 billion of these bonds, with the remaining ¥2 billion redeemed on February 21, 2025.

Also Read: Where Will Bitcoin Be in 2030?

Metaplanet’s Role in Corporate Cryptocurrency Adoption

Metaplanet Inc. has emerged as one of Japan’s leading corporate adopters of cryptocurrency, following in the footsteps of global companies like MicroStrategy and Tesla that pioneered the integration of Bitcoin into corporate treasuries. As a technology company operating under TSE Standard 3350, Metaplanet has positioned itself at the intersection of traditional finance and digital assets.

The company has developed a unique approach to measuring and reporting the performance of its Bitcoin strategy through proprietary metrics including “BTC Yield,” “BTC Gain,” and “BTC ¥ Gain” – providing shareholders with transparent insights into how its cryptocurrency investments are performing relative to its corporate growth.

History of Metaplanet’s Bitcoin Strategy

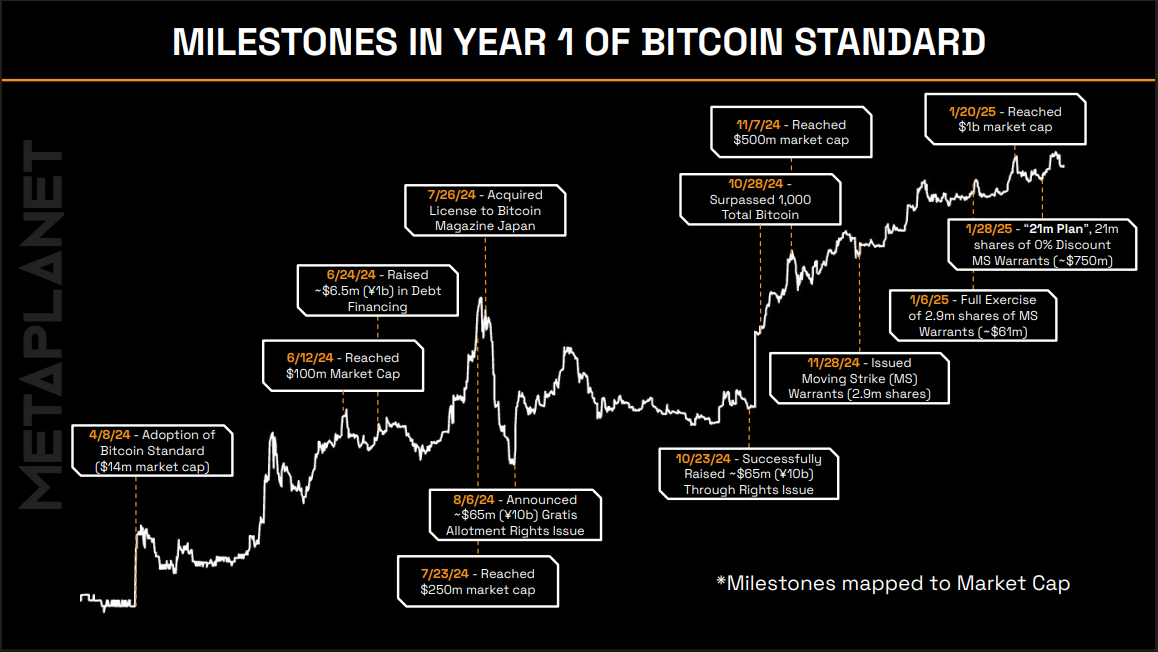

Metaplanet’s journey into Bitcoin began in early 2024, with initial purchases that were modest compared to its current holdings.

The company’s Bitcoin treasury strategy has evolved significantly over the past year:

- Q2 2024 (as of June 30, 2024): 141.073 Bitcoin with 18,169,218 issued common shares

- Q3 2024 (as of September 30, 2024): 398.832 Bitcoin with 18,169,218 issued common shares

- Q4 2024 (as of February 10, 2025): 1,762 Bitcoin with 36,268,334 issued common shares

- Q1 2025 (as of March 12, 2025): 3,050 Bitcoin with 44,248,334 issued common shares

This trajectory demonstrates remarkable growth, with Metaplanet increasing its Bitcoin holdings by over 20-fold in just nine months. The company doubled its Bitcoin reserves in the first quarter of 2025 alone, signaling an acceleration in its acquisition strategy.

Performance Metrics and Shareholder Value

Metaplanet has developed a sophisticated approach to measuring the performance of its Bitcoin treasury operations through three key metrics:

- BTC Yield: Defined as the percentage change in the ratio of Total Bitcoin Holdings to Fully Diluted Shares Outstanding over a given period. This metric has shown impressive results:

- July 1, 2024 to September 30, 2024: 41.7%

- October 1, 2024 to December 31, 2024: 309.8%

- January 1, 2025 to March 12, 2025: 53.2%

- BTC Gain: Represents the company’s total Bitcoin holdings at the beginning of a period multiplied by the achieved BTC Yield for that period. This quantifies the hypothetical increase in total Bitcoin holdings, assuming no new shares were issued, highlighting net Bitcoin accretion driven purely by the company’s Bitcoin Treasury Operations.

- BTC ¥ Gain: Expresses BTC Gain in Japanese yen by multiplying BTC Gain by the market price of Bitcoin at the end of the period, providing shareholders with a clearer view of the financial impact in local currency.

These metrics demonstrate that Metaplanet is not merely accumulating Bitcoin but is strategically integrating it into its business model in a way that aims to be “accretive to shareholders” according to company documents.

The rapid expansion of Bitcoin holdings has been made possible through an innovative financing mechanism involving EVO FUND. On January 28, 2025, Metaplanet’s Board of Directors approved the issuance of the 13th to 17th Series of Stock Acquisition Rights to EVO FUND, consisting of five tranches of 4.2 million shares each, totaling 21 million shares.[12] By March 12, 2025, the company had already achieved approximately 24.3% completion of this “21 Million Plan,” with net proceeds from the exercise of the 13th and 14th Series totaling approximately ¥20.263 billion.

Strategic Rationale for Bitcoin Investment

Metaplanet’s aggressive Bitcoin acquisition strategy appears to serve multiple purposes:

- Inflation Hedge: By converting a portion of its cash reserves into Bitcoin, Metaplanet aims to protect shareholder value against potential currency debasement and inflation.

- Treasury Diversification: The company is diversifying its treasury assets beyond traditional financial instruments into what it considers a digital store of value.

- Strategic Positioning: As a technology company, Metaplanet is aligning itself with emerging digital asset ecosystems, potentially opening new business opportunities and partnerships.

- Shareholder Value Creation: The company explicitly states that its Bitcoin strategy is “intended to be accretive to shareholders,” suggesting confidence that Bitcoin appreciation will outpace the dilution from newly issued shares.

Corporate Governance and Bitcoin Strategy

Metaplanet’s Bitcoin strategy is overseen by Representative Director Simon Gerovich, who has authorized each major purchase. The company operates under TSE Standard 3350, requiring it to maintain high standards of corporate governance and disclosure.

The company’s willingness to issue new shares (increasing from 18.1 million in Q3 2024 to 44.2 million by Q1 2025) suggests it may be raising capital specifically to fund Bitcoin acquisitions or using equity-based financing to support its digital asset strategy.

Bitcoin’s Performance During Metaplanet’s Acquisition Period

Metaplanet’s Bitcoin acquisition strategy has coincided with a period of significant price appreciation for the cryptocurrency. While Bitcoin experienced volatility throughout 2024, the overall trend has been positive:

- Early 2024: Bitcoin traded around $45,000

- Mid-2024: Prices reached approximately $65,000

- Late 2024: Bitcoin surpassed $80,000

- Early 2025: Prices have fluctuated between $80,000-$90,000

(Source: KuCoin Research)

This favorable price environment has benefited Metaplanet’s strategy, though the company’s average acquisition price of ¥12.6 million per Bitcoin (approximately $85,500) suggests many purchases occurred near recent highs, demonstrating conviction in Bitcoin’s long-term value proposition despite short-term price volatility.

Metaplanet’s Place in the Corporate Bitcoin Adoption Trend

Metaplanet joins a growing list of publicly traded companies adopting Bitcoin as a treasury asset. This trend began in earnest with MicroStrategy’s initial $250 million Bitcoin purchase in August 2020, followed by Tesla’s $1.5 billion investment in early 2021.

What distinguishes Metaplanet is:

- Regional Leadership: As a Japanese corporation, Metaplanet represents one of the most significant corporate Bitcoin adopters in Asia.

- Relative Treasury Allocation: With over 3,000 Bitcoin representing billions of yen in investment, Metaplanet has committed a substantial portion of its treasury to digital assets.

- Unique Performance Metrics: The company’s development of specialized metrics like BTC Yield demonstrates a sophisticated approach to measuring and communicating the value of its Bitcoin strategy.

- Accelerating Acquisition Rate: The rapid increase in Metaplanet’s Bitcoin holdings over nine months shows an unusually aggressive acquisition strategy compared to many corporate peers.

Future Outlook for Metaplanet’s Bitcoin Strategy

Based on the acceleration of Metaplanet’s Bitcoin acquisitions in recent quarters, several potential future developments seem likely:

- Continued Accumulation: The company’s latest purchase suggests its Bitcoin acquisition strategy remains active, with potential for further significant purchases in 2025.

- Integration with Core Business: As Metaplanet’s Bitcoin holdings grow, the company may explore ways to integrate cryptocurrency with its core technology business, potentially including:

- Developing Bitcoin custody solutions

- Creating financial products based on its Bitcoin holdings

- Accepting cryptocurrency for its products and services

- Expanded Metrics and Reporting: The company may further refine its Bitcoin performance metrics to help shareholders understand the value proposition of its cryptocurrency strategy.

- Potential Regulatory Navigation: As a Japanese corporation with significant cryptocurrency holdings, Metaplanet will need to navigate evolving regulatory frameworks, potentially influencing broader corporate cryptocurrency adoption in the region.

Conclusion

Metaplanet Inc.’s latest ¥2 billion Bitcoin purchase represents a significant milestone in the company’s evolving treasury strategy. With total holdings now reaching 3,050 Bitcoin valued at over ¥38.4 billion, the company has established itself as one of Japan’s leading corporate cryptocurrency adopters.

Through its sophisticated approach to measuring Bitcoin performance with metrics like BTC Yield, BTC Gain, and BTC ¥ Gain, Metaplanet is providing a potential blueprint for other corporations considering similar treasury diversification strategies.

As the company continues to expand its Bitcoin holdings while growing its issued share count, market observers will be watching closely to see if this strategy delivers the shareholder value that Metaplanet’s leadership anticipates. For now, the company’s aggressive acquisition trajectory suggests strong conviction in Bitcoin’s long-term proposition as both a store of value and a strategic corporate asset.

Want real-time updates on Bitcoin, Ethereum, and blockchain trends? Crypto News Today delivers breaking crypto news, expert insights, and price movements to keep you informed.

Note: This article is based on information from Metaplanet Inc.’s official notice dated March 12, 2025. Market values in USD are approximate conversions based on current exchange rates.