Bitcoin mining is often described as the backbone of the Bitcoin network. But for newcomers to cryptocurrency, the concept can seem complex and mysterious. This article breaks down the Bitcoin mining process, explaining how it works, why it’s necessary, and what it means for the broader cryptocurrency ecosystem.

What Is Bitcoin Mining?

Bitcoin mining is the process by which new bitcoins are created and transactions are added to the blockchain—Bitcoin’s public ledger. The process involves solving complex mathematical puzzles using specialized computer hardware, which requires significant computational power and electricity.

According to the Cambridge Bitcoin Electricity Consumption Index, as of March 2025, Bitcoin mining consumes approximately 178.55 TWh (terawatt-hours) per year, comparable to the energy consumption of countries like Norway or Argentina.

The Core Functions of Bitcoin Mining

Mining serves three crucial functions in the Bitcoin ecosystem:

- Creating new bitcoins: Mining is the only way new bitcoins enter circulation. Miners are rewarded with new bitcoins for their efforts.

- Verifying transactions: Miners validate transactions and add them to the blockchain.

- Securing the network: The computational power required for mining makes it extremely difficult and expensive for malicious actors to attack the network.

Also Read: Belarus President Supports Bitcoin Mining

How Bitcoin Mining Works: A Step-by-Step Process

1. Transaction Collection

When users send bitcoin to each other, these transactions are broadcast to the network and collected by miners into what’s called a “mempool” (memory pool).

2. Block Formation

Miners select transactions from the mempool to include in a “block”—a collection of transactions. Miners typically prioritize transactions with higher fees, as these provide additional rewards.

3. The Proof-of-Work Challenge

For a block to be added to the blockchain, miners must solve a computational puzzle known as “proof-of-work.” This involves:

- Finding a valid hash: Miners repeatedly modify a small piece of data called a “nonce” and run it through a cryptographic hash function (SHA-256) until they find a hash value that meets specific criteria.

- The difficulty target: The Bitcoin network automatically adjusts the difficulty of this puzzle approximately every two weeks to maintain an average block creation time of 10 minutes.

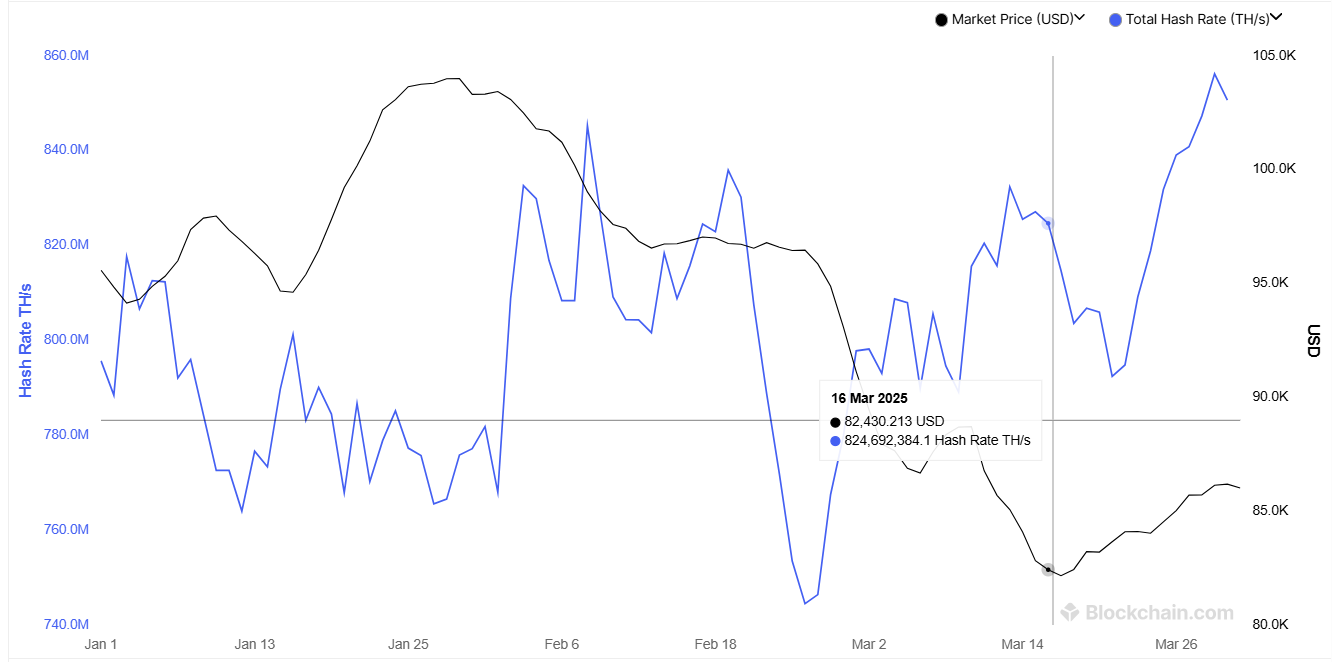

As of March 2025, the Bitcoin network hash rate reached an all-time high of approximately 579 EH/s (exahashes per second), representing a 26% increase year-over-year

4. Block Verification and Addition

When a miner successfully solves the puzzle:

- They broadcast their solution to the network

- Other miners verify the solution and confirm its validity

- The block is added to the blockchain

- The successful miner receives a reward

5. The Mining Reward

Miners currently receive two types of rewards:

- Block subsidy: New bitcoins created with each block. As of March 2025, following the April 2024 halving event, this stands at 3.125 BTC per block.

- Transaction fees: Fees paid by users to prioritize their transactions.

Mining Hardware Evolution

Bitcoin mining hardware has evolved dramatically since Bitcoin’s inception:

- CPU Mining (2009-2010): Initially, mining could be done with regular computer processors.

- GPU Mining (2010-2013): Graphics processing units offered significant performance improvements.

- FPGA Mining (2011-2013): Field Programmable Gate Arrays provided better efficiency.

- ASIC Mining (2013-Present): Application-Specific Integrated Circuits, designed solely for mining, revolutionized the industry.

The latest generation of ASIC miners, like the Bitmain Antminer S21 and MicroBT Whatsminer M60, achieve efficiency ratings of 17-19 J/TH (joules per terahash), a remarkable improvement from earlier models that required 100+ J/TH.

Mining Pools

Due to the increasing difficulty of mining, individual miners have slim chances of solving blocks alone. Mining pools emerged as a solution, allowing miners to:

- Combine computational resources

- Share rewards proportionally to contributed work

- Receive smaller but more consistent payments

As of March 2025, the largest mining pools include Foundry USA (25.2% of hashrate), AntPool (19.7%), and F2Pool (14.1%).

The Environmental Impact

Bitcoin’s energy consumption has drawn criticism from environmental advocates. However, the industry is evolving:

- An estimated 52.6% of Bitcoin mining uses renewable energy sources as of October 2024, up from 46% in 2022.

- Mining operations increasingly target stranded or excess energy resources that would otherwise go unused.

- Several major mining companies have pledged carbon-neutral operations by 2030.

The Economics of Mining

Mining profitability depends on several factors:

- Hardware costs: Top-tier ASIC miners cost between $5,000-$15,000.

- Electricity prices: Miners seek locations with electricity costs under $0.05 per kWh.

- Bitcoin price: Directly affects revenue.

- Network difficulty: Higher difficulty means more competition for the same rewards.

According to a report by CoinShares, the weighted average cash cost among listed miners was approximately $55,950 per Bitcoin in the third quarter of 2024. This figure represents a 13% increase from the previous quarter, primarily due to rising network hashrate and operational expenses.

The Future of Bitcoin Mining

Several trends will likely shape mining in the coming years:

- Continued efficiency improvements: New hardware designs promise even lower energy consumption per hash.

- Geographic diversification: Following China’s mining ban in 2021, mining has spread globally, with the US, Kazakhstan, and Russia leading in hashrate distribution.

- Integration with energy grids: Some mining operations now partner with utilities to stabilize electrical grids, absorbing excess energy during low-demand periods and shutting down during peak demand.

- Regulatory developments: Countries are increasingly developing specific regulations for cryptocurrency mining, focusing on energy usage and taxation.

Getting Started with Mining

For beginners interested in Bitcoin mining:

- Research thoroughly: Understand the costs, technical requirements, and regulatory environment in your location.

- Consider alternatives: For many individuals, purchasing Bitcoin directly may be more cost-effective than mining.

- Start small: If determined to mine, consider joining a reputable mining pool with a smaller investment before scaling up.

- Stay informed: The mining landscape changes rapidly with new hardware, difficulty adjustments, and Bitcoin price movements.

Conclusion

Bitcoin mining is a fascinating intersection of cryptography, economics, and computing that forms the foundation of the world’s first and largest cryptocurrency. While increasingly competitive and resource-intensive, it remains essential to Bitcoin’s security and decentralization.

Whether you’re considering mining as an investment or simply want to understand how Bitcoin works, appreciating the complexity and purpose of the mining process is key to grasping the revolutionary nature of blockchain technology.

Get real-time updates on Crypto News Today with cryptocurrency prices, blockchain innovations, and institutional crypto adoption. Learn how major financial players like BlackRock are influencing the future of digital assets.