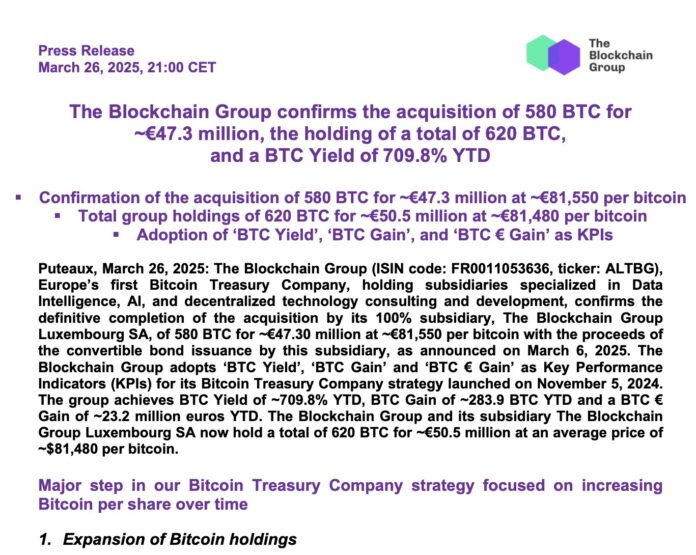

Paris, France – In a landmark decision that promises to reshape the financial technology landscape, The Blockchain Group (TBG) has executed a strategic purchase of 580 Bitcoin for €47.3 million, signaling a profound shift in corporate approaches to digital assets and challenging traditional notions of corporate treasury management.

The Transaction: A Calculated Strategic Move

The acquisition, representing an average purchase price of approximately €81,550 per Bitcoin, transcends a mere financial transaction. It embodies a calculated, forward-looking strategy that positions TBG at the forefront of technological and financial innovation. This move arrives at a critical juncture in the cryptocurrency ecosystem, where institutional interest is rapidly transforming from cautious observation to active participation.

Historical Context and Market Evolution

Bitcoin’s journey from a technological curiosity to a serious financial asset has been remarkable. When the cryptocurrency first emerged in 2009, traditional financial institutions dismissed it as a speculative experiment. Today, it commands the attention of sophisticated global investors and forward-thinking corporations.

The path to institutional adoption has been marked by key milestones. In 2013, initial corporate interest began to emerge. By 2020, major corporations started exploring Bitcoin as a treasury asset. The watershed moment came in 2021 with Tesla’s $1.5 billion Bitcoin investment, which significantly legitimized cryptocurrency as a corporate financial strategy.

Strategic Rationale Behind the Investment

The €47.3 million investment reveals multiple strategic considerations that extend beyond simple financial speculation. As a hedge against inflation, Bitcoin presents a decentralized alternative to traditional currency. Unlike fiat currencies subject to governmental manipulation, Bitcoin offers a fixed supply of 21 million coins, providing a potential store of value during economic uncertainty.

For The Blockchain Group, the investment is a perfect alignment of technological identity and financial strategy. The company demonstrates not just financial acumen but a deep commitment to digital transformation. This approach represents a sophisticated reimagining of corporate treasury management, moving beyond traditional asset allocation models.

Market Dynamics and Potential Impact

The immediate market reaction to TBG’s investment has been notably measured. Unlike previous large-scale Bitcoin purchases that triggered immediate price volatility, this transaction suggests a more mature approach to cryptocurrency investment.

The purchase could catalyze interest among other European tech companies, potentially inspiring more conservative corporate treasury departments to explore digital assets. France’s progressive regulatory environment provides a supportive framework for such innovative financial strategies.

Technological and Economic Landscape

At the time of investment, Bitcoin demonstrated several compelling characteristics. The cryptocurrency showed increased institutional legitimacy, with growing acceptance from financial institutions. Its blockchain infrastructure demonstrated enhanced security, while market liquidity improved with more sophisticated trading products.

Regulatory Considerations

France has emerged as a progressive jurisdiction for blockchain and cryptocurrency innovation. The country’s balanced approach provides clear regulatory guidelines, supports technological innovation, ensures robust consumer protection, and offers transparent taxation frameworks for digital assets.

ALSO READ :How to Buy Bitcoin?

Expert Perspectives

Industry experts offer nuanced insights into the investment. Marie Laurent, a prominent Paris-based digital assets analyst, describes the move as “strategic technological positioning.” She emphasizes that understanding digital assets is now a core competency for forward-thinking tech companies.

Dr. François Martin, a blockchain economics researcher, views the investment as a fundamental reimagining of corporate treasury management. In his assessment, Bitcoin is transitioning from an alternative asset to an increasingly mainstream financial instrument.

Risk Management and Mitigation

TBG has carefully considered potential risks associated with the investment. Market volatility is addressed through a long-term investment strategy and diversified acquisition approach. The company mitigates regulatory uncertainty through continuous monitoring of global developments and a proactive compliance strategy.

Technological risks are managed through robust security protocols, advanced custody solutions, and ongoing technological assessment. This comprehensive approach demonstrates a mature and calculated approach to digital asset investment.

Future Outlook and Projected Trends

The investment suggests several emerging trends in the cryptocurrency landscape. Corporate Bitcoin adoption is expected to increase, with regulatory clarity likely to enhance. Investment strategies will become more sophisticated, and cryptocurrency is poised for deeper integration into mainstream financial products.

Conclusion: A Technological and Financial Inflection Point

The Blockchain Group’s €47.3 million Bitcoin purchase represents far more than a financial transaction. It symbolizes a broader technological and economic transformation, challenging traditional concepts of corporate investment and signaling a new era of digital asset integration.

This strategic move positions TBG as a forward-thinking technological leader, demonstrating the potential for innovative financial strategies in the digital age. By embracing Bitcoin, the company signals its commitment to technological innovation and its ability to navigate the complex landscape of digital assets. Check cryptonewstoday for latest updates

Disclaimer: Cryptocurrency investments involve significant risks. Potential investors should conduct comprehensive research and consult financial professionals before making investment decisions.