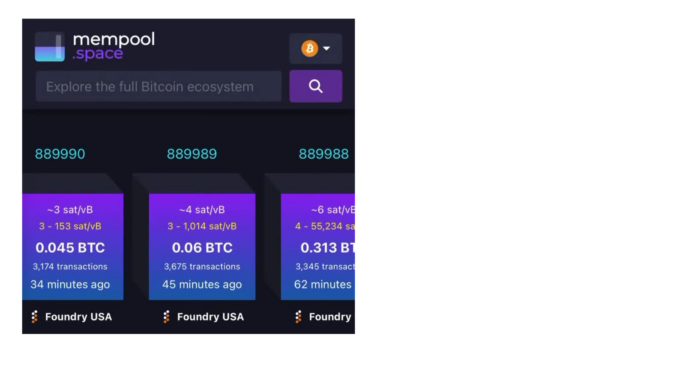

In an unusual display of mining dominance, Foundry USA has successfully mined nine consecutive Bitcoin blocks, a rare occurrence in Bitcoin’s mining history that has caught the attention of industry observers and market participants alike.

The Mining Streak

Foundry USA, one of North America’s largest Bitcoin mining pools, has achieved what many consider a statistical anomaly by mining nine blocks in a row on the Bitcoin blockchain. This streak represents a significant concentration of mining power during the period in question.

In Bitcoin’s decentralized network, mining pools compete to solve complex mathematical puzzles, with the winner earning the right to add a new block to the blockchain approximately every 10 minutes. The probability of any single pool mining consecutive blocks is determined by its share of the network’s total computing power (hashrate).

Foundry USA has been one of the dominant mining pools in recent years, typically controlling between 20-30% of Bitcoin’s total hashrate. However, even with this substantial share, the probability of mining nine consecutive blocks is extremely low, calculated at roughly 0.002% assuming a 25% hashrate.

Historical Context

This is not the first time mining pools have experienced unusual streaks. In July 2023, Antpool mined seven consecutive blocks, and similar occurrences have been documented throughout Bitcoin’s history. However, nine consecutive blocks represents one of the longer sequences observed in recent years.

For context, Bitcoin’s design intentionally makes block discovery somewhat random. Even pools with significant hashrate can go through periods without finding any blocks, followed by clusters of discoveries. This variance is built into the system and helps maintain decentralization despite the emergence of large mining pools.

Market Impact Analysis

Short-term Price Movement

Bitcoin’s price showed minimal direct reaction to the mining streak, consistent with historical patterns where mining pool activities rarely impact immediate price movement unless they signal broader network concerns. The price continued to follow broader market trends rather than responding to this specific mining event.

Mining Decentralization Metrics

This streak has reignited discussions about mining centralization, a persistent concern in the Bitcoin ecosystem. Historical data shows mining pool concentration has fluctuated significantly over Bitcoin’s lifetime:

- In Bitcoin’s early years (2009-2013), mining was highly distributed among individual miners

- The 2014-2017 period saw significant concentration in Chinese mining pools, with some occasionally approaching 40% of hashrate

- Since 2020, there has been a geographic redistribution following China’s mining ban, with North American entities like Foundry gaining prominence

Foundry USA’s current position as a dominant mining pool aligns with this evolving trend, though overall mining decentralization metrics remain healthier than during previous concentration peaks.

Hashrate Distribution Comparisons

Comparing today’s hashrate distribution with historical patterns reveals interesting trends:

- 2015-2018: Top 3 pools regularly controlled over 50% of hashrate

- 2019-2021: Increased distribution with top pool typically under 20%

- 2022-present: Moderate reconcentration with top pools including Foundry, Antpool, and F2Pool each controlling significant portions

While Foundry’s consecutive block mining demonstrates their significant presence, the overall hashrate distribution remains more diverse than during previous centralization peaks in Bitcoin’s history.

Technical Implications

The streak has prompted technical discussions about Bitcoin’s random block assignment mechanism. Bitcoin’s mining difficulty adjusts approximately every two weeks to maintain the 10-minute block time regardless of total network hashrate. While short-term variance can lead to mining streaks like Foundry’s, the long-term distribution of blocks typically aligns with hashrate contribution.

Statistical analysis of block distribution over the past year shows:

- Actual block rewards generally correlate with reported hashrate shares

- Short-term variances regularly occur but balance out over time

- No evidence of systematic deviation that would indicate technical issues

Industry Expert Perspectives

Mining pool concentration has historically drawn varying opinions from Bitcoin experts. Notable perspectives from previous similar events can inform our understanding:

Bitcoin developers have consistently maintained that temporary mining concentration does not threaten network security absent a 51% attack scenario. During previous concentration events, they pointed to Bitcoin’s design, which makes sustained dominance both economically and technically challenging.

Mining economists have noted that profit-maximizing behavior naturally limits long-term concentration, as miners tend to redistribute hashrate when a single pool becomes too dominant.

Foundry USA’s Growth Trajectory

Foundry USA’s rise to prominence represents a significant shift in Bitcoin’s mining landscape. Launched in 2020 by Digital Currency Group, Foundry has rapidly expanded its market share through strategic partnerships with North American miners.

Historical comparison with other dominant pools shows:

- GHash.io briefly exceeded 50% hashrate in 2014 before miners voluntarily redirected hashpower

- Bitmain-operated pools dominated from 2017-2019

- Foundry’s ascent coincided with the post-China ban redistribution of mining power

Unlike previous dominant pools that were primarily based in China, Foundry represents the shift toward North American mining operations following regulatory changes globally.

Regulatory Considerations

The geographic shift in mining power toward North America, exemplified by Foundry USA’s prominence, intersects with evolving regulatory frameworks:

- US regulators have increasingly recognized Bitcoin mining as a legitimate industry

- Previous concentration in China raised concerns about geographic centralization and government influence

- Current distribution across multiple jurisdictions potentially reduces regulatory risk

Historical precedent suggests that mining distribution tends to respond to regulatory pressures, with activity shifting toward favorable jurisdictions.

Energy Consumption Context

Bitcoin mining’s energy consumption remains a topic of ongoing debate. Foundry USA has positioned itself within this conversation by highlighting commitments to renewable energy usage.

Compared to historical mining operations:

- Early Bitcoin mining (2009-2014) had negligible energy impact

- The 2017-2021 period saw exponential growth in energy consumption

- Recent years have shown increased focus on renewable energy sources and energy efficiency

Foundry’s operations, like other major North American miners, tend to employ a higher percentage of renewable energy than the historical average for Bitcoin mining, reflecting industry evolution in response to environmental concerns.

Network Health Assessment

Bitcoin’s network health metrics remain strong despite temporary mining concentration:

- Transaction confirmation times remain consistent with historical averages

- Fee markets function normally

- No indication of block censorship or transaction filtering

These observations align with historical patterns that show Bitcoin’s network-level metrics typically remain stable despite shifts in mining pool distribution.

Long-term Market Implications

Analyzing similar historical mining concentration events suggests several potential long-term implications:

Mining Pool Competitive Dynamics

Periods of high concentration have typically been followed by redistribution as miners adjust their pool participation. Following GHash.io’s near-majority hashrate in 2014, miners quickly redistributed their resources to maintain network decentralization. A similar response occurred after Bitmain-affiliated pools gained significant market share in 2018.

Market Trust Considerations

Bitcoin’s value proposition is partially built on its decentralized nature. Historical market data shows increased sensitivity to centralization concerns during periods of mining concentration:

- The market briefly reacted negatively to GHash.io’s 2014 concentration event

- Subsequent concentration events have elicited progressively milder market responses as ecosystem maturity increased

This suggests that market participants have developed more nuanced views of mining centralization risks over time.

ALSO READ : BlackRock Buys One Hundred Eight Million Dollars in Bitcoin

Conclusion

Foundry USA’s achievement of mining nine consecutive Bitcoin blocks represents a statistical anomaly rather than a fundamental shift in Bitcoin’s security model or market structure. Historical comparisons suggest such events, while noteworthy, are temporary manifestations of mining variance rather than indicators of systemic issues.

The mining streak highlights Foundry’s significant position in the evolving landscape of Bitcoin mining, representing the broader shift from Chinese dominance to a more globally distributed model with significant North American participation.

From a market perspective, this event fits within Bitcoin’s ongoing maturation, where mining pool dynamics remain an important but increasingly well-understood component of the ecosystem. While mining centralization concerns persist, the historical trajectory suggests continued adaptation and adjustment by market participants to maintain Bitcoin’s fundamental value proposition of decentralization.

As with previous instances of mining concentration, this event will likely prompt healthy ecosystem discussions about mining decentralization while having minimal direct impact on Bitcoin’s market performance or fundamental security model.

Never miss a beat in the crypto world! Check Crypto News Today for Bitcoin updates, Ethereum news, and the latest blockchain trends shaping the future of digital assets.