Robert Kiyosaki, the renowned author of Rich Dad Poor Dad, has been a vocal supporter of Bitcoin for years, predicting that the digital currency will play a critical role in the financial world. His bold predictions about Bitcoin’s future have drawn both support and skepticism, especially as the cryptocurrency market remains volatile and unpredictable. Kiyosaki’s most recent statement, predicting Bitcoin’s rise to a much higher value by 2025, has generated significant buzz in both the financial and cryptocurrency communities. But is his bullish prediction for Bitcoin in 2025 based on solid reasoning, or is it another speculative forecast?

Kiyosaki’s Bitcoin Vision:

Kiyosaki’s bullish outlook on Bitcoin is not new. He has repeatedly stated that Bitcoin, along with other assets like gold and silver, is a hedge against the inflationary policies of central banks and government debt. He believes that traditional currencies, such as the US dollar, are doomed to devaluation due to government policies, especially in light of the growing global debt crisis.

In his latest forecast, Kiyosaki claims that Bitcoin could reach $500,000 by 2025. This statement has raised eyebrows, considering the extreme volatility Bitcoin has exhibited over the years. The cryptocurrency reached an all-time high of nearly $69,000 in late 2021, only to see a dramatic decline in value afterward. This has led to doubts about Bitcoin’s ability to reach such a high value in just a few years. So, does Kiyosaki’s prediction make sense? Let’s take a closer look.

Factors Supporting Kiyosaki’s Prediction:

- Increasing Institutional Adoption: One of the key factors behind Kiyosaki’s optimism is the growing institutional adoption of Bitcoin and other cryptocurrencies. Over the past few years, an increasing number of institutional investors, such as hedge funds, publicly traded companies, and investment firms, have started to invest in Bitcoin as part of their portfolios. Major companies like Tesla, Square (now Block), and MicroStrategy have made substantial Bitcoin investments, and this trend appears to be continuing.

The entrance of institutional investors into the crypto space brings more legitimacy and stability to the market, and it is possible that this could push Bitcoin’s value higher. Institutional investors bring significant capital and could be more likely to hold Bitcoin long-term, reducing the supply available for trading and driving prices up.

- Inflation Hedge and Economic Instability: Another factor supporting Kiyosaki’s prediction is the ongoing global economic uncertainty. The massive government spending and money-printing programs implemented by central banks in response to the COVID-19 pandemic have led to rising inflation rates in many parts of the world. Kiyosaki views Bitcoin as a store of value that is not subject to inflationary pressures, unlike fiat currencies such as the US dollar.

As the global economy faces more challenges—such as inflation, devaluation of the dollar, and political instability—Bitcoin’s appeal as a hedge against these risks could grow. Investors seeking protection from currency devaluation may increasingly turn to Bitcoin as a safe haven, further driving up demand.

- Increased Regulatory Clarity: As cryptocurrencies become more mainstream, governments around the world are beginning to develop clearer regulations around their use and taxation. Regulatory clarity could help Bitcoin gain wider adoption and could lead to more institutional and retail investors entering the market. This could help stabilize Bitcoin’s price and contribute to long-term growth.

Countries like El Salvador, which adopted Bitcoin as legal tender, are setting an example, and if other nations follow suit, it could add more legitimacy to Bitcoin’s value proposition as a globally accepted digital currency.

- Limited Supply: Bitcoin’s supply is capped at 21 million coins, which means that unlike fiat currencies, Bitcoin cannot be inflated. This scarcity has always been one of the key selling points for Bitcoin advocates. The limited supply of Bitcoin ensures that, as demand increases, the price could rise significantly. With fewer Bitcoins being mined over time and a limited number available, the scarcity factor could push prices upwards.

Challenges to Kiyosaki’s Prediction:

Despite these supporting factors, there are several challenges that could prevent Bitcoin from reaching the heights Kiyosaki predicts.

- Regulatory Risks: One of the biggest risks to Bitcoin’s growth is regulatory uncertainty. Many governments have been cautious about fully embracing Bitcoin, with concerns over money laundering, illegal activities, and investor protection. If governments implement stricter regulations or outright bans on Bitcoin, it could harm its price and disrupt the market.

While some countries like El Salvador are embracing Bitcoin, others, such as China, have cracked down on cryptocurrency trading and mining. The regulatory environment remains one of the biggest wildcards for Bitcoin’s future, and any unfavorable regulations could undermine Kiyosaki’s prediction.

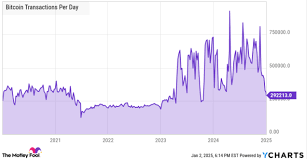

- Market Volatility: Bitcoin is notoriously volatile. The cryptocurrency market has seen significant price swings, with Bitcoin’s value plummeting by more than 50% at times, as it did in 2022. This volatility makes it difficult for many investors to view Bitcoin as a stable store of value. If Bitcoin continues to experience sharp fluctuations, it may deter mainstream adoption and make it less attractive as a long-term investment.

Investors may be hesitant to hold Bitcoin if they perceive it as too risky or speculative, which could limit its potential for substantial growth in the short term.

- Competition from Other Cryptocurrencies: Bitcoin is often referred to as the “king of cryptocurrencies,” but it faces increasing competition from other digital assets. Newer cryptocurrencies, such as Ethereum, Solana, and Cardano, are gaining popularity due to their technological innovations and faster transaction speeds. These altcoins may provide better utility and use cases than Bitcoin, which could limit Bitcoin’s dominance in the market.

Additionally, central bank digital currencies (CBDCs) are being developed by various countries, which could offer a more stable and regulated alternative to Bitcoin.

Robert Kiyosaki’s bullish prediction for Bitcoin in 2025 is based on factors like growing institutional adoption, inflation concerns, and Bitcoin’s limited supply. While these factors are compelling, there are still significant challenges to Bitcoin reaching $500,000 by 2025, including regulatory risks, market volatility, and competition from other cryptocurrencies.

Ultimately, Kiyosaki’s prediction may be optimistic, but it is not entirely without merit. Bitcoin’s potential as a hedge against inflation and its growing role in the global financial system could drive its value higher. However, investors should remain cautious and understand the risks involved, as Bitcoin’s future remains uncertain and highly volatile.