MicroStrategy’s Executive Chairman says Bitcoin has moved past its “riskiest period” and is entering an era of institutional adoption that will drive prices to seven figures.

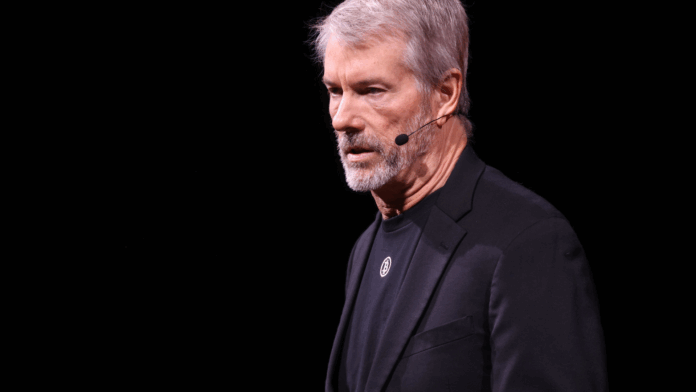

Michael Saylor, Executive Chairman and CEO of MicroStrategy (rebranded as Strategy), delivered a bold proclamation during a recent Bloomberg interview: Bitcoin’s bear market days are over, and the cryptocurrency is destined to reach $1 million per coin.

BREAKING: BILLIONAIRE MICHAEL SAYLOR TELLS BLOOMBERG #BITCOIN IS GOING TO $1 MILLION AND THAT THERE WILL NEVER BE ANOTHER CRYPTO WINTER

COMPANIES AND ETFS “ARE BUYING THE ENTIRE SUPPLY.” PARABOLIC SOON ? pic.twitter.com/Vv7qSRIgst

— The Bitcoin Historian (@pete_rizzo_) June 10, 2025

“Winter Is Not Coming Back”

In his characteristic bullish tone, Saylor dismissed concerns about future Bitcoin downturns. “Winter is not coming back,” he stated emphatically. “We are past that phase. If Bitcoin is not going to zero, it is going to $1 million.”

The billionaire Bitcoin advocate framed the current market environment as a “digital gold rush,” warning investors they have limited time to accumulate the cryptocurrency. “You’ve got ten years to acquire all your bitcoin before there’s no bitcoin left for you,” Saylor declared.

Political and Regulatory Tailwinds

Saylor’s confidence stems largely from what he sees as a fundamental shift in the U.S. regulatory landscape. He cited strong political support for Bitcoin across the current administration, noting that “The President of the United States is determined. He supports Bitcoin, the cabinet supports Bitcoin, Scott Bessent supports Bitcoin, Paul Atkins has shown himself to be an enthusiastic believer of Bitcoin and digital assets.”

This regulatory clarity, according to Saylor, means “Bitcoin has gotten through its riskiest period” – the era of hostile government stance and restrictive regulations that previously created uncertainty in the market.

Institutional Adoption Accelerating

The Strategy CEO pointed to rapidly increasing institutional participation as a key driver of his bullish outlook. He highlighted the meteoric rise of Japanese company Metaplanet, which has seen its market capitalization surge from $10 million to $5 billion as it adopted a Bitcoin treasury strategy.

“Metaplanet is the hottest company in Japan right now,” Saylor noted. “They’re going to raise billions of dollars. They’re going to pull the liquidity out of the Japanese market.”

Supply and Demand Dynamics

Saylor emphasized the fundamental supply-demand imbalance driving Bitcoin’s price higher. He explained that only 450 BTC are available for sale daily from “natural sellers,” representing approximately $50 million in daily supply.

Meanwhile, institutional buyers are absorbing this supply rapidly. MicroStrategy itself acquired 1,045 BTC for $110 million just this week, while Bitcoin ETFs continue to accumulate massive positions. BlackRock’s Bitcoin ETF (IBIT) has already surpassed $70 billion in assets within 341 trading days, holding nearly 700,000 BTC.

Stay ahead with real-time crypto live news updates on Bitcoin, Ethereum, altcoins, market trends, and blockchain innovations.

Strategy’s Unique Bitcoin-Backed Financial Products

MicroStrategy’s approach extends beyond simple Bitcoin accumulation. The company has developed what Saylor describes as a unique business model focused on issuing Bitcoin-backed financial instruments.

“We’re the only company in the world that’s ever been able to issue a preferred stock backed by Bitcoin,” Saylor explained. “We’ve done three of them in the past five months.”

The company positions itself not as a competitor to Bitcoin treasury companies or ETFs, but as targeting the traditional $100 trillion bond and preferred stock markets. “We offer 400 basis points more yield on an instrument that is much more heavily collateralized and more transparent,” he said.

International Expansion and Corporate Adoption

Saylor’s bullish thesis extends beyond U.S. borders, noting that international firms are rapidly entering the Bitcoin space. He characterized this as “cooperative” rather than competitive, suggesting that widespread adoption will benefit all participants.

Major corporations like GameStop and Trump Media are reportedly raising funds to increase their Bitcoin holdings, while nation-states are exploring Strategic Bitcoin Reserves.

Long-term Price Projections

When pressed about potential price volatility, Saylor remained unfazed. “If Bitcoin rallies to $500K or $1 million, then maybe we can talk about it crashing down by $200,000 a coin,” he said, suggesting that even significant corrections from much higher levels wouldn’t constitute a return to bear market conditions.

The Strategy founder concluded with characteristic confidence about competition from traditional financial giants: “I’m not really worried about competition from JPMorgan or Berkshire Hathaway. I would love for them to enter the Bitcoin space, buy up a bunch of Bitcoin. When they do it, they’ll be paying $1,000,000 a Bitcoin. The price will go to the moon.”

Market Context

Saylor’s comments come as Bitcoin continues trading above $109,000, having maintained levels above $100,000 for 30 consecutive days for the first time in its history. The cryptocurrency has shown remarkable resilience and institutional acceptance, with multiple Bitcoin ETFs now holding substantial positions and corporate treasuries increasingly adopting Bitcoin as a reserve asset.

Whether Saylor’s $1 million prediction proves accurate remains to be seen, but his influence on corporate Bitcoin adoption and his company’s pioneering role in Bitcoin-backed financial products make his perspective particularly noteworthy for investors and institutions considering cryptocurrency exposure.

CryptoNewsToday is a leading platform providing the latest updates, trends, and analysis in the cryptocurrency world. Stay informed with timely news on Bitcoin, altcoins, blockchain technology, and more.