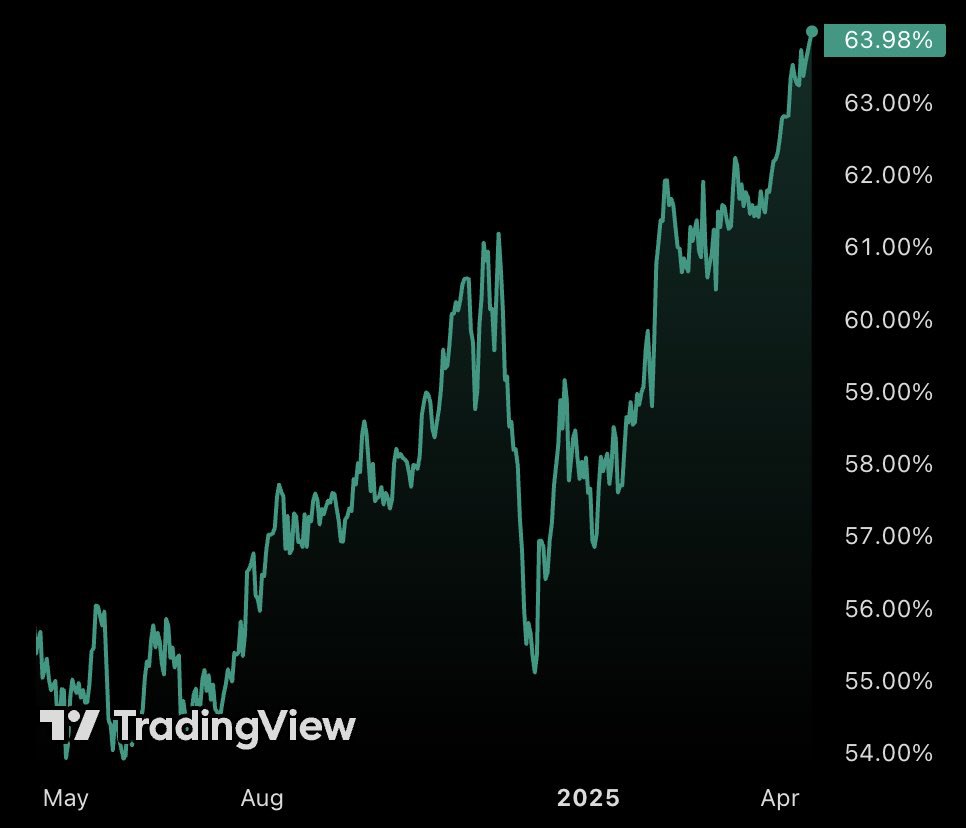

Bitcoin’s dominance in the cryptocurrency market has reached a significant milestone, climbing to nearly 64% of the total crypto market capitalization, a level not seen since January 2021. This surge in Bitcoin’s market share comes amid a broader backdrop of global economic uncertainty and highlights the flagship cryptocurrency’s enduring appeal as a digital safe haven.

Record-Breaking Dominance

According to recent market data, Bitcoin dominance has climbed to approximately 63.95%, representing an increase of 0.16% in the most recent trading session. The metric, which measures Bitcoin’s market capitalization as a percentage of the entire cryptocurrency market, has seen significant growth across multiple timeframes:

- 3.55% increase over the past month

- 8.42% growth over the last six months

- 10.12% rise year-to-date

- 15.35% expansion over the past year

This dramatic rise comes as Bitcoin’s price has demonstrated remarkable resilience, approaching the $86,000 mark despite various macroeconomic headwinds.

Altcoins Under Pressure

The surge in Bitcoin’s market dominance has coincided with notably weaker performance across the altcoin sector. Major cryptocurrencies like Ethereum have experienced significant declines relative to Bitcoin, with the ETH/BTC ratio reaching multi-year lows. This pattern suggests a risk-off sentiment in crypto markets, with investors consolidating capital into Bitcoin at the expense of smaller, more speculative digital assets.

This shift in market dynamics has contributed to a contraction in the overall cryptocurrency market capitalization, which has decreased to approximately $2.79 trillion, further emphasizing Bitcoin’s outperformance relative to the broader market.

Macro Factors Driving the Trend

Several macroeconomic factors appear to be fueling Bitcoin’s increasing dominance:

- Global Economic Uncertainty: Concerns over U.S. trade policies and potential tariffs have prompted investors to seek assets perceived as more stable within the cryptocurrency ecosystem.

- Strong U.S. Dollar: The persistent strength of the U.S. dollar has created headwinds for risk assets broadly, with Bitcoin demonstrating greater resilience than its smaller counterparts.

- Flight to Quality: During periods of market volatility, investors typically gravitate toward established assets with greater liquidity and institutional adoption – qualities that Bitcoin possesses in abundance within the crypto sector.

Also Read: President Trump Embraces Crypto Future: Promises Economic Growth and U.S. Financial Leadership

Historical Context and Potential Implications

Historically, extended periods of high Bitcoin dominance have often preceded significant market shifts. The current level of approximately 64% represents a key resistance area based on previous market cycles. A sustained break above this threshold could signal continued Bitcoin outperformance, while rejection could potentially trigger a rotation into altcoins.

Market analysts remain divided on the implications:

- Bullish View: Some interpret the rising dominance as a sign of Bitcoin’s fundamental strength and growing institutional acceptance, potentially setting the stage for a push toward the psychologically important $90,000 level.

- Cautious Perspective: Others point to technical resistance in the 64-65% range and patterns such as a potential bearish rising wedge, suggesting the dominance metric may be approaching a cyclical peak.

What This Means for Investors

For cryptocurrency investors, Bitcoin’s surging dominance carries several implications:

- Portfolio Allocation: The current market environment may favor higher Bitcoin allocation relative to altcoins, at least until global economic uncertainties subside.

- Altcoin Opportunity: Historically, peaks in Bitcoin dominance have eventually led to “altcoin seasons” when capital rotates back into smaller cryptocurrencies. Patient investors may find value in currently underperforming altcoins with strong fundamentals.

- Market Timing Challenges: While dominance trends can provide context, they don’t reliably predict short-term price movements. Both Bitcoin and the broader market could experience volatility regardless of dominance shifts.

Conclusion

Bitcoin’s market cap dominance approaching 64% marks a significant milestone in the cryptocurrency ecosystem’s evolution. While this metric highlights Bitcoin’s current strength relative to altcoins, it’s important to recognize that market dynamics can shift rapidly based on changing macroeconomic conditions, regulatory developments, or shifts in investor sentiment.

As with all cryptocurrency metrics, Bitcoin dominance should be considered as one of many factors in market analysis rather than a definitive predictor of future price action. The coming weeks will likely provide clearer indicators of whether the 64% level represents a ceiling for Bitcoin’s market share or merely a stepping stone to even greater dominance in the digital asset space.

Want real-time updates on Bitcoin, Ethereum, and blockchain trends? Crypto News Today delivers breaking crypto news, expert insights, and price movements to keep you informed.