Bitcoin’s institutional adoption has been a key narrative in the cryptocurrency market, yet its price action has not necessarily mirrored the increased inflows from major financial players. BlackRock’s Head of Digital Assets recently stated that while institutional adoption of Bitcoin is growing significantly, its impact is yet to be fully reflected in Bitcoin’s price. This raises critical questions about market cycles, supply-demand dynamics, and macroeconomic influences on Bitcoin’s valuation.

In this article, we explore the reasons behind this price-adoption disconnect, examine historical data to identify trends, and evaluate the potential future impact of institutional participation in Bitcoin markets.

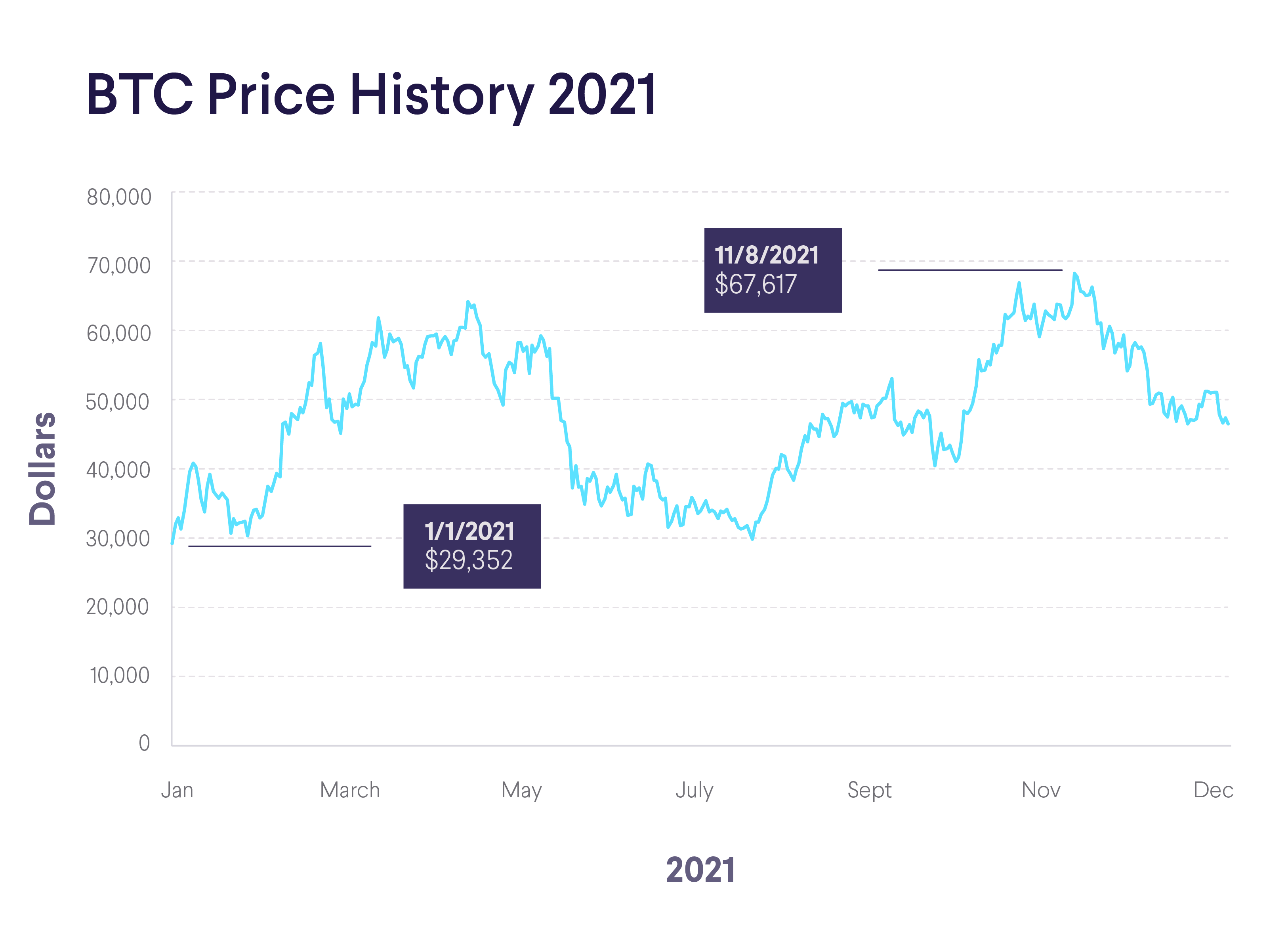

Source image taken from Coingape

Institutional Adoption and Bitcoin’s Price Disconnect

Institutional interest in Bitcoin has surged over the past few years, driven by factors such as regulatory clarity, financial product innovation, and macroeconomic hedging strategies. The launch of Bitcoin ETFs by major asset managers like BlackRock and Fidelity has enabled traditional investors to gain exposure to Bitcoin without direct ownership. However, despite these advancements, Bitcoin’s price remains volatile and has yet to break past its previous all-time highs in a sustained manner.

Factors Behind the Price-Impact Lag

Experts argue that the slow reflection of institutional adoption in Bitcoin’s price can be attributed to several factors:

- Market Liquidity and Absorption: The Bitcoin market, though growing, is still relatively small compared to traditional asset classes like equities and bonds. Even with institutional buying, the selling pressure from long-term holders, miners, and speculative traders can offset demand. Unlike traditional financial markets, Bitcoin is subject to high volatility due to its relatively illiquid nature.

- Macroeconomic Conditions: Global economic factors play a significant role in Bitcoin’s price. High interest rates, inflation concerns, and regulatory uncertainties in major economies like the U.S. have kept risk appetite in check. Institutional investors, though interested in Bitcoin, may be hesitant to increase exposure due to uncertain macroeconomic conditions.

- Regulatory Constraints: While institutional involvement has grown, stringent regulatory policies and compliance requirements prevent full-scale adoption by pension funds, endowments, and conservative financial institutions. Many traditional investment firms require clear legal frameworks before fully integrating Bitcoin into their portfolios.

- Derivative Market Influence: The dominance of Bitcoin futures and options trading can sometimes decouple spot prices from actual demand and supply dynamics. With leveraged positions, short-term speculative trading in derivatives markets can influence Bitcoin’s price without corresponding increases in spot market accumulation.

- Market Sentiment and Retail Participation: Institutional inflows alone may not be sufficient to drive an immediate price surge. Historically, retail investors have played a crucial role in Bitcoin’s price rallies. If retail interest remains muted due to economic uncertainty, Bitcoin’s price might not react strongly to institutional accumulation.

Historical Data: Comparing Institutional Interest vs. Market Trends

Historically, Bitcoin’s price has responded positively to institutional inflows but with significant delays. The timeline of key institutional developments and Bitcoin’s price movements provides insights into this pattern:

Source image is taken from sofi.com

The 2020-2021 Bull Market: Institutional FOMO

- In late 2020 and early 2021, Bitcoin surged to $64,000 after major companies like Tesla, MicroStrategy, and institutional funds added Bitcoin to their balance sheets.

- The launch of Bitcoin futures ETFs and growing interest from hedge funds contributed to the price increase.

- However, despite this growth, Bitcoin faced sharp corrections, partly due to profit-taking and regulatory concerns in China and the U.S.

The 2022 Bear Market: Institutional Accumulation Amid Decline

- The market downturn saw Bitcoin plunge below $20,000, despite continued institutional accumulation.

- Rising interest rates and the collapse of major crypto firms (such as FTX) triggered panic selling and a loss of confidence among retail investors.

- BlackRock, Fidelity, and other asset managers continued expanding their crypto-related offerings during this period, indicating long-term confidence in Bitcoin’s viability.

The 2024 ETF Approval: Price Surge and Subsequent Correction

- The approval of spot Bitcoin ETFs in early 2024 was expected to be a major catalyst for a new bull run.

- Bitcoin initially surged past $45,000 but has since struggled to maintain upward momentum.

- The slower-than-expected price reaction suggests that institutional participation alone is not enough to drive an explosive rally.

Market Impact and Future Outlook

While Bitcoin’s price remains subdued relative to expectations, the increasing presence of institutional investors provides long-term structural support. Analysts believe that several key factors could influence Bitcoin’s future trajectory:

1. The Supply Shock Theory

One of the strongest arguments for future price appreciation is the potential for a supply shock. With institutions accumulating Bitcoin at a rapid pace, the available supply on exchanges is decreasing. Historically, Bitcoin’s bull runs have often been preceded by periods of declining exchange reserves.

2. Regulatory Developments and Institutional Onboarding

Greater regulatory clarity in key markets like the U.S. and Europe could unlock trillions of dollars from institutional investors currently hesitant to enter the market. Approval of additional crypto-based financial products, such as Ethereum ETFs or Bitcoin yield-generating instruments, could further solidify Bitcoin’s role in institutional portfolios.

3. Macroeconomic Factors: Interest Rates and Inflation

Bitcoin has increasingly been viewed as a hedge against inflation and currency devaluation. If central banks shift towards more accommodative monetary policies, Bitcoin could benefit from renewed investor interest. Historical trends indicate that Bitcoin has performed well in periods of low-interest rates and high inflation concerns.

4. Retail Investor Resurgence

Despite institutional growth, retail investors remain a critical driver of Bitcoin’s price. A resurgence in retail participation—driven by favorable economic conditions, media coverage, and speculative interest—could amplify the impact of institutional buying and lead to a stronger price uptrend.

Conclusion: A Delayed but Inevitable Price Impact?

While BlackRock’s Head of Digital Assets highlights the disconnect between institutional adoption and Bitcoin’s price, history suggests that market cycles and external factors play a critical role. Institutional accumulation may not lead to immediate price surges, but it establishes a strong foundation for future growth.

If institutions continue to accumulate Bitcoin at the current pace while macroeconomic conditions improve, the eventual price impact could be significant. Investors should remain mindful of broader market forces and regulatory developments while keeping an eye on Bitcoin’s supply-demand dynamics.

In summary, the long-term outlook for Bitcoin remains bullish, with institutional adoption acting as a stabilizing force. However, Bitcoin’s price action will continue to be influenced by a combination of macroeconomic conditions, market sentiment, and regulatory progress. Patience may be required before the full effects of institutional involvement are reflected in Bitcoin’s valuation. Check cryptonewstoday for latest updates