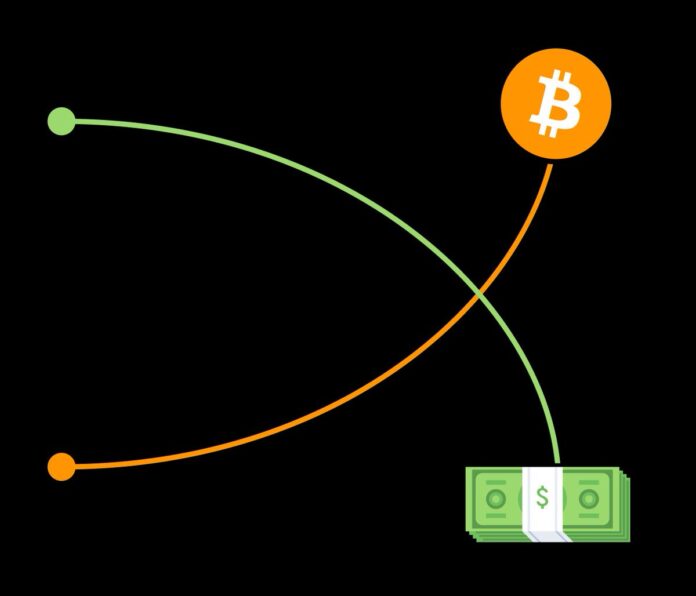

In the rapidly evolving landscape of global finance, Bitcoin continues to challenge traditional monetary systems with its fundamental value proposition: scarcity in an era of unlimited fiat currency expansion. This perspective, encapsulated in the phrase “Bitcoin has no top because fiat has no bottom,” has profound implications for investors, policymakers, and the broader economic ecosystem.

Historical Context: Fiat Currency Expansion

Since the abandonment of the gold standard in 1971, major world currencies have operated as pure fiat systems, with central banks able to create new money without the constraints of physical backing. This monetary flexibility has led to significant expansion of the money supply across global economies.

The U.S. dollar’s M2 money supply grew from approximately $686 billion in 1971 to over $21.6 trillion by October 2024, representing a 31-fold increase. Following the 2008 financial crisis, the Federal Reserve expanded its balance sheet from $900 billion to nearly $9 trillion at its peak in 2022. During the COVID-19 pandemic alone, the U.S. money supply increased by approximately $6 trillion in just two years.

This pattern isn’t unique to the United States. The European Central Bank, Bank of Japan, and other major monetary authorities have pursued similar expansionary policies. Japan’s government debt has exceeded 260% of GDP, while the Eurozone has maintained negative interest rates for extended periods, reflecting the extraordinary monetary measures employed to stimulate economic growth.

Bitcoin’s Price History: Responding to Monetary Policy

Bitcoin’s price movements have historically demonstrated sensitivity to periods of significant monetary expansion. Following the 2008 global financial crisis and subsequent quantitative easing, Bitcoin emerged and began its first major price appreciation cycle. The post-pandemic monetary stimulus coincided with Bitcoin’s surge from approximately $5,000 in March 2020 to nearly $69,000 by November 2021.

Between major bull cycles, Bitcoin has experienced substantial corrections, including over 80% declines, yet each cycle has established higher floors than previous ones. The 2018 bear market found support around $3,200, significantly higher than the previous cycle’s bottom of approximately $200. Following the 2022 correction, Bitcoin stabilized around $16,000, again establishing a higher floor.

This cyclical pattern has led many analysts to develop stock-to-flow models and other quantitative frameworks attempting to project Bitcoin’s long-term price trajectory. While these models remain controversial, they generally point to continued appreciation against fiat currencies over multi-year timeframes.

Market Analysis: The Inflation Hedge Thesis

Bitcoin’s performance as an inflation hedge has shown mixed but increasingly compelling results. During the 2021-2023 inflation surge, Bitcoin initially declined alongside other risk assets but subsequently recovered more robustly than traditional markets. Countries experiencing extreme inflation, such as Argentina, Turkey, and Venezuela, have seen significant Bitcoin adoption rates despite regulatory hurdles.

Institutional adoption has accelerated, with major financial entities like MicroStrategy, BlackRock, and Fidelity developing significant Bitcoin positions or investment products. MicroStrategy, under CEO Michael Saylor, has accumulated over 150,000 bitcoins, making it the largest corporate holder. BlackRock’s spot Bitcoin ETF attracted billions in inflows within months of launch, signaling mainstream financial acceptance.

Paul Tudor Jones, billionaire hedge fund manager, noted in his 2020 market outlook: “Bitcoin reminds me of gold in the 1970s. The best profit-maximizing strategy is to own the fastest horse, and Bitcoin might be it.” Ray Dalio, founder of Bridgewater Associates, shifted from skepticism to acknowledging Bitcoin as a potential “gold-like asset alternative” in portfolios.

Even traditional banking institutions have gradually embraced Bitcoin’s potential. Morgan Stanley, Goldman Sachs, and JPMorgan now offer various crypto investment options to clients, despite earlier institutional resistance. This mainstreaming represents a significant shift in perception from Bitcoin’s early days as a fringe financial experiment.

The Fiat Debasement Argument

The core argument for Bitcoin’s unlimited upside potential rests on the continued debasement of fiat currencies through expansion of money supply. Historical precedents support concerns about fiat sustainability:

The Roman denarius saw its silver content reduced from 95% to less than 5% over two centuries, contributing to the empire’s economic challenges. The Weimar Republic’s hyperinflation in the 1920s rendered the German mark essentially worthless. More recently, Zimbabwe and Venezuela have experienced hyperinflation that decimated their national currencies.

While developed economies have sophisticated mechanisms to manage currency stability, the unprecedented scale of global debt (exceeding $300 trillion) and continued deficit spending raise questions about long-term fiat sustainability. Each dollar of economic growth now requires multiple dollars of new debt, creating what some economists view as a potential debt trap.

Bitcoin advocates argue that its fixed supply of 21 million coins provides mathematical certainty against the risks of monetary expansion. This predictability contrasts sharply with fiat systems, where supply changes depend on centralized policy decisions influenced by political and economic pressures.

Technological and Network Development

Bitcoin’s value proposition extends beyond its monetary policy. The network has demonstrated remarkable resilience over fifteen years of operation, with 99.98% uptime and resistance to various attack vectors. The Lightning Network, a second-layer scaling solution, has expanded capacity significantly, enabling faster and cheaper transactions that address earlier scalability concerns.

Institutional infrastructure continues to mature, with custody solutions, insurance products, and regulatory compliance tools developing rapidly. These improvements lower adoption barriers for conservative institutional players still approaching the asset class cautiously.

Mining operations have evolved from hobbyist activities to sophisticated industrial operations, often utilizing renewable energy sources. The increasing professionalization of mining has strengthened Bitcoin’s security model while addressing environmental criticisms through improved energy efficiency and renewable integration.

Critical Perspectives

Not all financial experts share the unlimited upside thesis. Critics point to Bitcoin’s persistent volatility, making it challenging as a unit of account or stable store of value in the short term. Regulatory uncertainty could impede mainstream adoption, with differing approaches across jurisdictions creating compliance complexities.

The emergence of central bank digital currencies (CBDCs) might address some inefficiencies in the current financial system without requiring cryptocurrency adoption. As of late 2024, over 20 countries have launched or are piloting CBDCs, with China’s digital yuan leading in scale and sophistication.

Jerome Powell, Federal Reserve Chairman, acknowledged in congressional testimony that Bitcoin serves as “essentially a substitute for gold rather than for the dollar,” suggesting its role may be more limited than proponents believe. Traditional economists like Nouriel Roubini continue to question Bitcoin’s fundamental value, arguing that it lacks intrinsic utility beyond speculative investment.

Environmental concerns persist despite industry improvements, with Bitcoin’s energy consumption remaining substantial even as it increasingly utilizes renewable sources. These criticisms have led some institutional investors to favor other digital assets with different consensus mechanisms.

Global Adoption Landscape

Bitcoin adoption varies dramatically across regions, reflecting different economic conditions and regulatory approaches. El Salvador’s 2021 decision to adopt Bitcoin as legal tender represented a watershed moment, though implementation challenges have tempered initial enthusiasm. Other Latin American countries have shown interest in following suit, particularly those struggling with currency stability or remittance inefficiencies.

In regions experiencing high inflation or currency controls, such as Turkey, Argentina, and Nigeria, grassroots Bitcoin adoption has grown organically despite official restrictions. These natural experiments provide real-world evidence for Bitcoin’s utility in challenging monetary environments.

Advanced economies have taken varied regulatory approaches. The United States has increasingly normalized Bitcoin through regulated futures markets, ETF approvals, and clearer tax guidance. The European Union’s Markets in Crypto-Assets (MiCA) regulation has created a comprehensive framework that legitimizes while controlling cryptocurrency activities. Japan and Singapore have developed progressive regulatory environments that balance innovation with consumer protection.

Future Outlook

The ongoing tension between Bitcoin’s fixed supply model and fiat currency’s unlimited expansion capability creates a natural experiment in monetary theory. Several factors will likely influence Bitcoin’s trajectory:

Continued monetary policy decisions, particularly around interest rates and quantitative easing/tightening cycles, will test Bitcoin’s countercyclical properties. The resolution of current inflationary pressures in major economies will either validate or challenge Bitcoin’s inflation hedge narrative.

Institutional adoption rates and integration with traditional financial infrastructure will determine how much capital flows into the Bitcoin ecosystem. Current trends suggest continued mainstreaming, with financial products becoming increasingly sophisticated and accessible.

Regulatory developments across major economies will shape Bitcoin’s legal status and usability. While outright bans seem increasingly unlikely in Western democracies, the regulatory framework continues to evolve with implications for custody, taxation, and compliance requirements.

Technological improvements in Bitcoin’s scalability and energy consumption will address persistent criticisms. Layer-2 solutions and sidechains continue to expand functionality while maintaining the core network’s security properties.

Conclusion

While Bitcoin’s ultimate ceiling remains unknown, the thesis that it could continue appreciating against fiat currencies over the long term finds support in monetary history. As central banks navigate complex economic challenges with monetary policy as their primary tool, Bitcoin’s proposition as a mathematically limited asset continues to attract investors seeking protection from currency devaluation.

Whether Bitcoin truly has “no top” remains to be seen, but its fifteen-year journey from obscurity to mainstream financial discourse represents one of the most remarkable monetary experiments in modern history. The tension between centralized monetary control and decentralized alternatives may ultimately result in a hybrid financial system that incorporates elements of both approaches.

For investors, the proposition remains compelling yet uncertain: in a world where fiat currencies face unprecedented expansion, assets with credible scarcity may continue commanding premium valuations. Bitcoin’s position as the first and largest cryptocurrency provides it with substantial network effects and brand recognition that competitors struggle to match.

As traditional financial systems grapple with mounting debt loads and demographic challenges, Bitcoin offers an alternative vision of money—one based on mathematical certainty rather than policy discretion. This fundamental contrast ensures that regardless of short-term price movements, the experiment in digital scarcity will remain relevant to financial markets for years to come. Check cryptonewstoday for latest updates

ALSO READ : Strategy Invests $10.7M in 130 Bitcoin