In a significant development for cryptocurrency regulation in the United States, Senator Jim Justice has publicly declared his support for the BITCOIN Act, stating emphatically that “It is time to support the BITCOIN Act!” The announcement, which comes amid ongoing debate about cryptocurrency’s role in the modern financial ecosystem, has sent ripples through both digital asset markets and traditional financial circles.

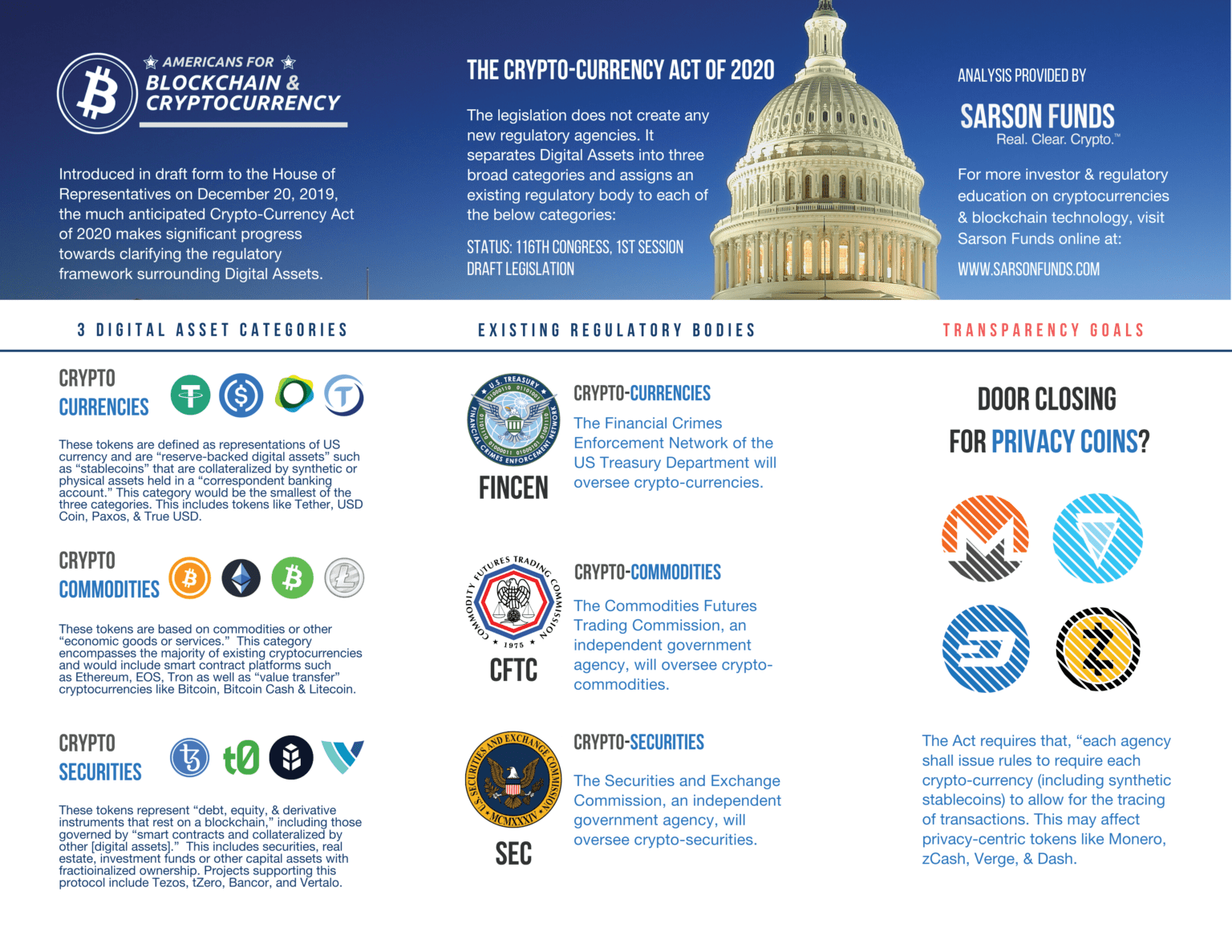

Source image taken from sarsonfunds

The BITCOIN Act: Regulatory Framework in Focus

The Blockchain Innovation and Technologies for Consumer Opportunities and Investment Needs (BITCOIN) Act represents one of the most comprehensive legislative attempts to create a balanced regulatory framework for cryptocurrencies in the United States. While the full details of the legislation remain under discussion, sources familiar with the matter indicate that the Act aims to provide clear guidelines for cryptocurrency operations while protecting consumers and fostering innovation.

Senator Justice’s support adds significant political momentum to the legislation, which has previously faced mixed reactions from lawmakers across party lines. Justice, known for his pragmatic approach to economic policy, emphasized that proper regulation could help legitimize the cryptocurrency market while addressing concerns about illicit usage and market manipulation.

Immediate Market Reaction

Following Senator Justice’s endorsement, Bitcoin experienced a 4.7% price increase within hours of the announcement, with the flagship cryptocurrency climbing above $124,000. Other major cryptocurrencies followed suit, with Ethereum rising 3.2% and Solana gaining 5.1%. This positive price action reflects the market’s optimistic interpretation of the potential for clearer regulatory guidelines.

“This immediate market response mirrors historical patterns we’ve seen when positive regulatory news emerges,” explains Dr. Miranda Chen, Chief Cryptocurrency Analyst at Global Investment Partners. “When regulators signal a path forward rather than outright restrictions, the market typically responds favorably.”

Historical Context: How Regulatory Announcements Have Shaped Cryptocurrency Markets

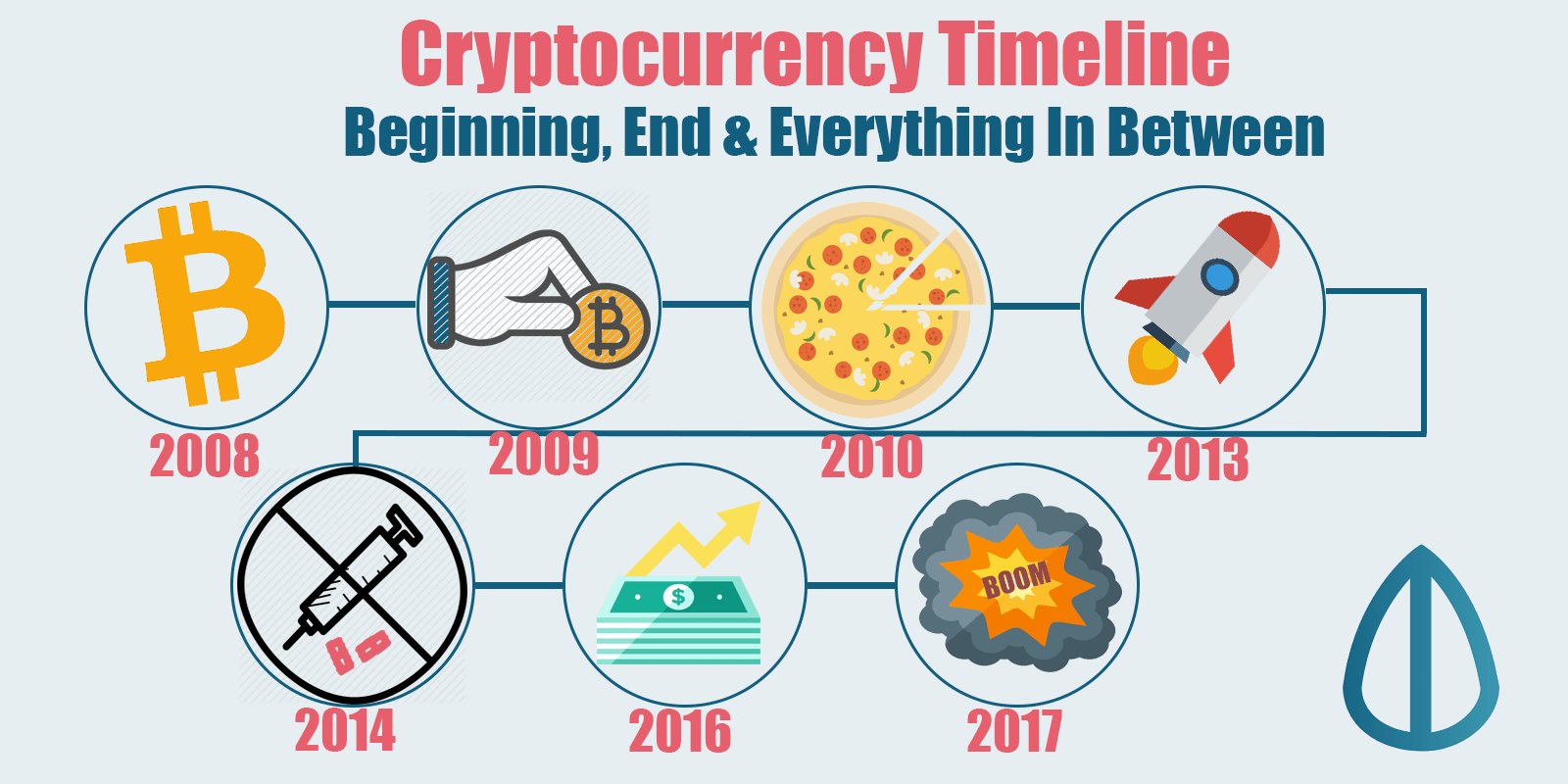

To understand the potential long-term impact of Senator Justice’s announcement, it’s crucial to examine how previous regulatory developments have influenced cryptocurrency markets throughout their history.

The 2013-2014 Cycle: Early Regulatory Awareness

When Bitcoin first caught mainstream attention during its 2013 price surge to over $1,000, regulatory responses were largely reactionary. In December 2013, the People’s Bank of China prohibited Chinese financial institutions from processing Bitcoin transactions, causing an immediate 20% price drop and contributing to the extended bear market that followed.

“Early regulatory actions were often blunt instruments that reflected limited understanding of the technology,” notes Dr. Samantha Rivera, cryptocurrency historian at the Blockchain Policy Institute. “The market was smaller, less liquid, and therefore more susceptible to severe swings based on regulatory news.”

The 2017 ICO Boom and Regulatory Response

The 2017 bull market was largely driven by Initial Coin Offerings (ICOs), which raised billions in unregulated fundraising. The subsequent regulatory crackdown, particularly the SEC’s retroactive enforcement actions beginning in 2018, contributed significantly to the nearly 85% drawdown in Bitcoin’s price from its December 2017 peak to its December 2018 trough.

“The 2017-2018 cycle demonstrated how regulatory uncertainty can amplify market volatility,” says Thomas Williams, former commissioner at the Commodity Futures Trading Commission. “When clear guidelines don’t exist, the market tends to price in worst-case scenarios during downturns.”

The 2021 Institutional Adoption and El Salvador’s Bitcoin Law

The 2021 bull market featured significant institutional adoption coinciding with more nuanced regulatory approaches. When El Salvador announced its intention to adopt Bitcoin as legal tender in June 2021, Bitcoin experienced a short-term 20% rally, though this was ultimately overshadowed by broader market conditions.

“El Salvador’s Bitcoin Law represented the first instance of a sovereign nation embracing rather than merely tolerating cryptocurrency,” explains Maria Gonzalez, Latin American Cryptocurrency Policy Researcher. “Though a small economy, it established a precedent that larger regulatory bodies couldn’t ignore.”

The 2023 Regulatory Clarity Movement

The cryptocurrency recovery beginning in late 2023 coincided with greater regulatory clarity in major jurisdictions. When the European Union’s Markets in Crypto-Assets (MiCA) regulation provided a comprehensive framework in September 2023, the market capitalization of the cryptocurrency sector increased by approximately 15% over the subsequent month.

“MiCA demonstrated that thoughtful regulation need not stifle innovation,” observes Jonathan Lee, Director of Cryptocurrency Strategy at Atlantic Capital. “The market responded positively because participants could finally operate with defined parameters rather than regulatory ambiguity.”

Source image taken from coinmarketcap.com

Comparative Analysis: Justice’s Endorsement vs. Historical Regulatory Milestones

Senator Justice’s support for the BITCOIN Act shares characteristics with several historical regulatory developments but differs in key aspects that may influence its market impact.

Unlike early Chinese regulations or SEC enforcement actions against ICOs, which were primarily restrictive, the BITCOIN Act appears designed to create a functional framework. This approach more closely resembles MiCA’s comprehensive guidelines than piecemeal enforcement actions.

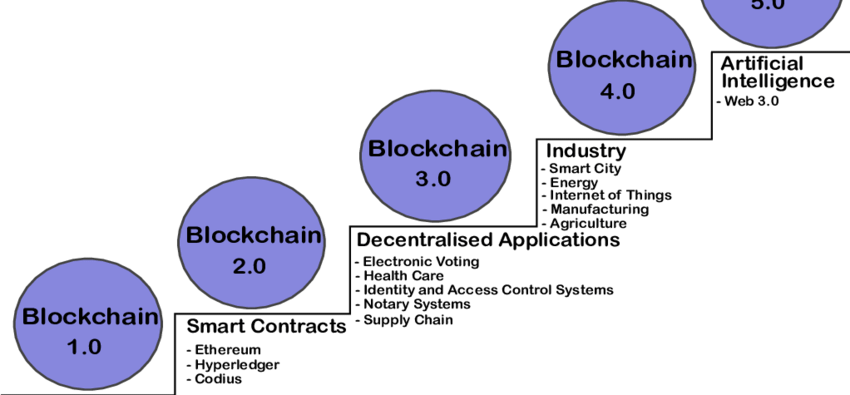

Source image taken from researchgate.net

“Justice’s endorsement signals that cryptocurrency regulation in the U.S. may be evolving from reactive enforcement to proactive framework-building,” suggests Rebecca Thompson, legal analyst specializing in financial technology. “This evolution typically correlates with reduced market volatility and sustainable growth.”

Potential Long-Term Market Implications Based on Historical Patterns

Analyzing previous regulatory cycles suggests several potential outcomes for cryptocurrency markets following Senator Justice’s announcement:

Source image is taken from thefinance.sg

Reduced Volatility

Historical data indicates that regulatory clarity typically correlates with reduced market volatility. Following Japan’s recognition of Bitcoin as a legal payment method in April 2017, Bitcoin’s 30-day volatility decreased by approximately 15% over the subsequent quarter.

“Clear regulations allow market participants to make decisions based on business fundamentals rather than regulatory fear,” explains Dr. Chen. “This typically leads to more rational price discovery and dampened boom-bust cycles.”

Institutional Participation

Previous instances of regulatory clarity have preceded increased institutional involvement. When the Office of the Comptroller of the Currency (OCC) issued guidance allowing U.S. banks to provide cryptocurrency custody services in July 2020, institutional investment in Bitcoin increased by approximately 60% over the following six months.

“Senator Justice’s support for the BITCOIN Act may accelerate institutional adoption by signaling that cryptocurrency is becoming an accepted part of the financial landscape,” notes William Blackstone, Chief Investment Officer at Digital Asset Management. “Institutions typically require regulatory certainty before making significant commitments.”

Market Maturation

Historical patterns suggest that progressive regulation correlates with market maturation. Following the introduction of regulated Bitcoin futures on the Chicago Mercantile Exchange (CME) in December 2017, the correlation between Bitcoin and traditional risk assets began a multi-year increase, indicating integration with broader financial markets.

“Regulatory frameworks tend to accelerate market maturation by encouraging standardized practices and transparent operations,” observes Dr. Rivera. “Senator Justice’s endorsement of the BITCOIN Act may similarly contribute to cryptocurrency’s evolution from speculative asset to established financial instrument.”

Expert Perspectives on Justice’s Announcement

Industry experts offer varied perspectives on the potential impact of Senator Justice’s support for the BITCOIN Act:

“This could represent a watershed moment for cryptocurrency regulation in the United States,” suggests Dr. Michael Harris, Professor of Financial Technology at Eastern University. “Previous regulatory developments have typically been fragmented across different agencies with sometimes conflicting approaches. A comprehensive framework could resolve these inconsistencies.”

Others are more cautious in their assessment. “While Senator Justice’s support is significant, the BITCOIN Act still faces a complex legislative journey,” notes Rebecca Wong, Director of Policy at the Cryptocurrency Council for Innovation. “Historical data suggests that markets often react prematurely to regulatory announcements before the lengthy implementation process unfolds.”

Conclusion: Contextualizing Justice’s Announcement Within Cryptocurrency’s Regulatory History

Senator Jim Justice’s declaration of support for the BITCOIN Act represents the latest chapter in cryptocurrency’s evolving regulatory narrative. Historical data suggests that regulatory developments of this nature typically prompt immediate market reactions followed by more sustained structural changes if implementation proceeds.

The cryptocurrency ecosystem has demonstrated remarkable resilience through multiple regulatory cycles, adapting to evolving guidelines while maintaining its fundamental value proposition. From China’s 2013 prohibitions to El Salvador’s 2021 adoption and Europe’s 2023 comprehensive framework, each regulatory milestone has contributed to the market’s maturation.

Source image taken from https://blog.unocoin.com/

Senator Justice’s support for the BITCOIN Act continues this progression, potentially accelerating cryptocurrency’s integration into the mainstream financial system while addressing longstanding concerns about consumer protection and market integrity. As with previous regulatory developments, the ultimate impact will depend not only on the legislation’s content but also on its implementation and the broader economic context in which it unfolds.

As cryptocurrency markets respond to this latest regulatory signal, market participants would be wise to consider the historical patterns outlined above while recognizing that past performance does not guarantee future results. The BITCOIN Act, whether ultimately enacted or not, represents another step in cryptocurrency’s journey from experimental technology to established financial infrastructure. Check cryptonewstoday for latest updates

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrency investments involve significant risk of loss.