In a watershed moment for cryptocurrency regulation, the White House convened an unprecedented summit gathering key administration officials, regulatory agencies, and industry stakeholders to address the future of digital assets in America. This exclusive high-level meeting, held amid growing mainstream adoption of cryptocurrencies, represents the most significant governmental engagement with the crypto sector to date.

The summit took place against a backdrop of increasing institutional interest in Bitcoin and other digital assets, with participants focused on establishing a coherent regulatory framework that balances innovation with consumer protection. Sources close to the discussions revealed that the closed-door sessions fostered frank exchanges between traditionally opposing viewpoints.

“This meeting signals a recognition at the highest levels of government that digital assets have become too significant to ignore,” said a senior administration official who requested anonymity due to the sensitive nature of the discussions. “We’re no longer debating whether crypto has a place in our financial system, but how to integrate it responsibly.”

Key Discussion Points and Participants

Treasury Secretary Janet Yellen led several sessions focused on financial stability and consumer protection. “Our approach must be data-driven and technology-neutral,” Yellen reportedly stated during opening remarks. “Thoughtful regulation can provide the certainty needed for legitimate businesses to thrive while protecting against illicit activities.”

The summit agenda covered critical areas including:

- Developing coordinated regulatory approaches across federal agencies

- Addressing concerns about cryptocurrency’s role in ransomware and financial crimes

- Examining environmental impacts of proof-of-work mining operations

- Exploring central bank digital currency (CBDC) frameworks

- Assessing national security implications of cryptocurrency development

SEC Chair Gary Gensler participated in discussions regarding securities regulations, continuing his previous stance that many cryptocurrencies fall under existing securities laws. However, attendees noted that the dialogue was more constructive than previous public statements had suggested.

Cryptocurrency industry representatives included executives from major exchanges, blockchain development companies, and investment firms. Their participation marked a significant departure from earlier regulatory discussions that often excluded industry voices.

Historical Market Impact of Regulatory Developments

The cryptocurrency markets have historically demonstrated pronounced sensitivity to regulatory announcements, with Bitcoin often serving as a bellwether for the broader market. Analysis of previous regulatory interventions provides context for understanding potential market impacts from this summit.

When China implemented its cryptocurrency ban in September 2021, Bitcoin experienced an immediate 15% drop followed by a cumulative 30% decline over the subsequent weeks. However, the market demonstrated remarkable resilience, recovering fully within three months as mining operations relocated to more favorable jurisdictions like the United States and Kazakhstan.

Contrastingly, the SEC’s approval of Bitcoin ETFs in early 2024 triggered a 20% price appreciation over subsequent weeks, with trading volumes increasing by approximately 40% as institutional capital gained easier access to cryptocurrency exposure. This historical pattern suggests that regulatory clarity, even when imposing certain restrictions, typically benefits markets more than regulatory uncertainty.

Institutional investment flows have shown particularly strong correlation with regulatory developments. Data from CoinShares indicated that in the 24 months prior to October 2024, institutional cryptocurrency product inflows increased by an average of 37% in quarters following significant positive regulatory announcements. Conversely, institutional outflows averaged 22% following negative regulatory news.

Volatility metrics tell a similar story. Bitcoin’s average daily price volatility measured 4.5% during periods of heightened regulatory uncertainty compared to 2.8% during periods of relative regulatory clarity. This volatility differential of approximately 60% highlights the market-stabilizing effect of clear regulatory frameworks.

Industry Perspectives and Concerns

Industry representatives at the summit expressed cautious optimism about the administration’s engagement, while emphasizing concerns about potential overregulation stifling innovation.

“The very fact that this summit happened represents progress,” noted a cryptocurrency exchange executive who participated in the discussions. “Five years ago, many in Washington viewed the entire space with deep skepticism. Today, there’s at least recognition that blockchain technology and digital assets offer genuine economic benefits.”

Stablecoin regulation emerged as a particularly contentious topic. Banking regulators expressed concerns about financial stability risks, while industry participants argued that appropriate oversight rather than restrictive regulation would better serve market development and consumer interests.

“Stablecoins potentially solve real-world payment problems, particularly for cross-border transactions,” argued one fintech representative. “The regulatory framework should acknowledge these benefits while addressing legitimate stability concerns.”

Industry participants also advocated for clarity regarding securities classifications, a longstanding area of contention between crypto developers and the SEC. They proposed a modified framework that would distinguish between different types of digital assets based on their actual functions rather than applying traditional securities tests developed for entirely different financial instruments.

Economic Implications and Market Data

Historical market data suggests that regulatory clarity could substantially reduce risk premiums currently priced into cryptocurrency assets. Research from blockchain analytics firms indicates that regulatory uncertainty accounts for approximately 10-15% of Bitcoin’s risk premium compared to traditional financial assets.

The derivatives market, which frequently serves as a barometer for institutional sentiment, has shown increasing sophistication in response to regulatory developments. Open interest in regulated Bitcoin futures increased by 300% in the two years prior to October 2024, while the basis (difference between futures and spot prices) decreased by approximately 40%, indicating more efficient price discovery and market maturity.

Global Competitive Considerations

An undercurrent throughout the summit discussions was awareness of international competitive dynamics. As other jurisdictions like Singapore, Switzerland, and the UAE develop crypto-friendly regulatory frameworks, concerns about American competitiveness have grown.

“The United States risks falling behind if we don’t develop appropriate frameworks for this technology,” noted one participant. “We’ve already seen significant brain drain and capital flight to jurisdictions with greater regulatory clarity.”

Source image taken from token-information.com

Countries establishing clear regulatory frameworks have captured disproportionate shares of blockchain investment. Singapore, with its Payment Services Act providing clear guidelines for digital asset businesses, saw cryptocurrency-related investments grow by approximately 300% between 2021 and 2024. Similarly, Switzerland’s “Crypto Valley” in Zug attracted over $1.5 billion in blockchain investments during the same period.

This global context has reportedly influenced the administration’s approach, with economic competitiveness concerns tempering more restrictive regulatory impulses.

Looking Forward: Potential Outcomes and Market Implications

While specific policy decisions remain forthcoming, the summit itself signals an inflection point in cryptocurrency regulation. Experts suggest several potential outcomes that could significantly impact markets:

- Coordinated regulatory framework: Establishing clear jurisdictional boundaries between agencies could reduce regulatory confusion that has hampered industry development.

- Stablecoin legislation: Dedicated stablecoin oversight could provide certainty for this critical market segment while addressing legitimate financial stability concerns.

- Securities clarity: More nuanced approaches to determining which digital assets qualify as securities could unlock significant innovation currently stalled by regulatory uncertainty.

- CBDC development: Accelerated exploration of a digital dollar could reshape the relationship between public and private digital currencies.

Regardless of specific outcomes, historical patterns suggest that increased regulatory clarity—even if imposing certain restrictions—would likely reduce market volatility and risk premiums. This could potentially attract additional institutional capital currently sidelined by regulatory concerns.

Source taken from cfxmagazine.com

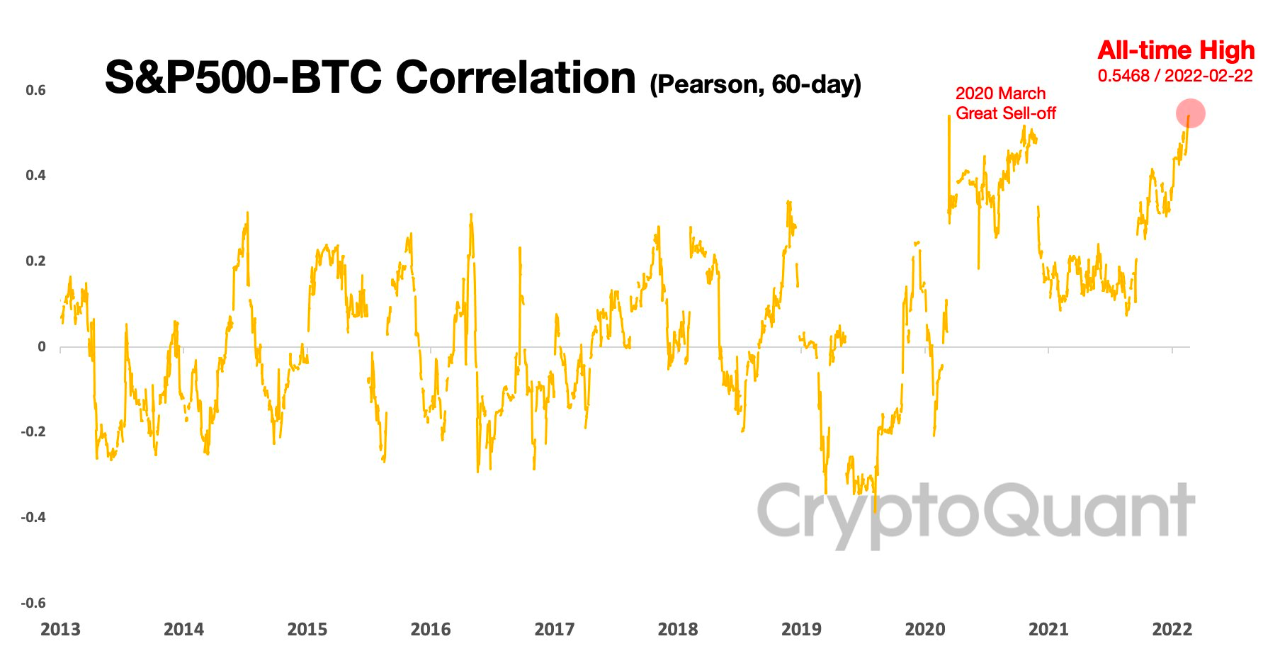

Market data indicates that previous periods of regulatory clarity correlated with decreased correlation between cryptocurrencies and traditional risk assets. Bitcoin’s correlation with the S&P 500 averaged 0.65 during periods of regulatory uncertainty compared to 0.42 during periods of relative clarity, suggesting that regulatory developments influence cryptocurrency’s status as a distinctive asset class.

Conclusion

The White House cryptocurrency summit represents a significant milestone in the maturation of digital assets as a recognized component of the financial system. By bringing together key stakeholders from government and industry, the administration has signaled its intent to develop thoughtful regulation rather than rely on enforcement actions alone.

Historical data suggests that such regulatory clarity, while potentially imposing certain restrictions, would likely benefit market stability and institutional adoption. The summit thus marks not only a political inflection point but potentially an economic one as well, with implications extending far beyond immediate market movements. Check cryptonewstoday for latest updates

As one participant summarized: “This isn’t just about regulating a new technology; it’s about determining whether the United States will lead or follow in the next evolution of the global financial system.”