As the crypto market experiences turbulence in 2025, investors are seeking reliable options that can weather the storm and potentially deliver strong returns when the bulls return. According to cryptocurrency expert Lyle Daly of The Motley Fool, bear markets offer excellent buying opportunities—provided you select your investments carefully.

“Bear markets tend to separate the crypto contenders from the pretenders,” writes Daly in his latest analysis. “Many cryptocurrencies never recover from their first downturn.“

In his April 29th report, Daly highlights three cryptocurrencies that he believes are well-positioned to survive current market challenges and deliver substantial long-term returns.

1. Monero (XMR): The Privacy Champion

Monero, currently priced at $277.82, has established itself as the leading privacy coin in the cryptocurrency ecosystem. Unlike most cryptocurrencies that record transactions on public blockchains visible to anyone, Monero offers complete transaction privacy—making them anonymous and untraceable.

“The value of Monero is readily apparent: It keeps your transactions and your holdings private,” Daly explains. “That’s a benefit that I expect some crypto users will always want.“

Several factors make Monero an attractive investment according to the analyst:

- Proven resilience: Since its 2014 launch, Monero has maintained a position among the top 25-50 cryptocurrencies by market capitalization, demonstrating staying power through multiple market cycles.

- Strong recent performance: With gains of 21% year-to-date and an impressive 90% increase over the past year, Monero has significantly outperformed both Bitcoin and the S&P 500.

- Clear use case: Unlike many crypto projects buried in technical jargon, Monero offers a straightforward value proposition that remains relevant regardless of market conditions.

With a current market capitalization of approximately $5 billion, Monero continues to attract investors seeking both privacy and potential growth.

2. Bitcoin (BTC): The Established Leader

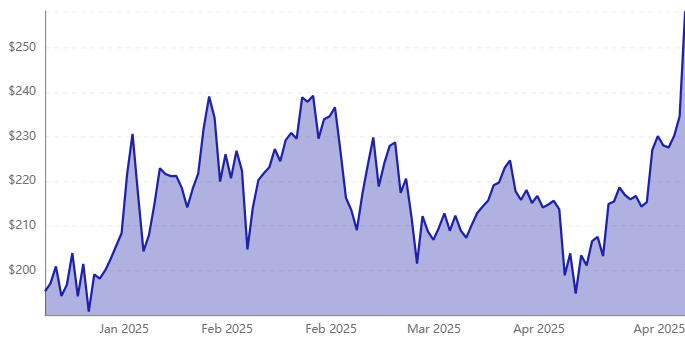

While acknowledging it might not be the most exciting recommendation, Daly positions Bitcoin as the safest option in the cryptocurrency space. Currently trading around $94,900, Bitcoin remains the oldest, most recognized, and largest cryptocurrency by a substantial margin.

“Bitcoin’s value comes from its built-in scarcity,” Daly notes. “The maximum supply is 21 million Bitcoin, and once those are all mined, there’s no way to make more of them.“

Several recent developments could drive increased Bitcoin investment:

- Institutional adoption: Following SEC approval of the first Bitcoin ETFs last year, professional investors managing over $100 million held $27.4 billion worth of Bitcoin ETFs by Q4 2024.

- Government backing: The Trump administration announced the creation of a Strategic Bitcoin Reserve in March 2025, with several states following suit with plans to stockpile Bitcoin.

Despite modest year-to-date growth of just 1%, Bitcoin’s performance looks stronger when compared to the S&P 500’s 7% decline over the same period. Bitcoin has gained 41% over the past year and Daly projects potential price targets reaching $150,000 within the next year or two.

Also Read: Financial Giants Unite: $3B Bitcoin Acquisition Firm Signals Institutional Crypto Surge

3. Solana (SOL): The Efficient Alternative

For investors willing to accept higher risk for potentially greater returns, Daly recommends Solana—currently trading at $148.87 and down 21% year-to-date. This price decline could present a buying opportunity for the smart contract blockchain that first emerged as an Ethereum competitor in 2021.

“What makes it special are speed and efficiency,” explains Daly. “Thanks to its proof-of-history model, Solana processes over 4,000 transactions per second (tps) and is reportedly capable of processing up to 65,000.“

Solana’s competitive advantages include:

- Low transaction costs: Average transaction fees of just $0.004, compared to an industry average of approximately $3 among Layer 1 blockchain networks.

- Growing ecosystem: With $7.7 billion in total value locked (TVL), Solana ranks second behind Ethereum ($50 billion) and attracted 7,625 new developers in 2024—making it the top blockchain for new development.

- Government recognition: President Trump has announced that Solana will be included in the U.S. Strategic Bitcoin Reserve, and the SEC is reviewing applications for Solana ETFs, which could attract additional institutional investment

Weathering the Storm

While Daly acknowledges that all cryptocurrency investments carry risk, he believes these three options have established sufficient market presence to endure the current bear market. Each offers distinct competitive advantages: Monero’s privacy features, Bitcoin’s scarcity and first-mover status, and Solana’s unmatched efficiency.

“I have all three in my wallet,” Daly concludes, “and while the crypto market is unpredictable, I expect them to be long-term winners.“

For investors considering entering the cryptocurrency market during this downturn, these recommendations provide a starting point for building a diversified portfolio positioned for potential recovery and growth.

Want real-time updates on Bitcoin, Ethereum, and blockchain trends? Crypto News Today delivers breaking crypto news, expert insights, and price movements to keep you informed.